Corporations of all stripes are attempting to glom onto AI pleasure. Even firms which can be solely tangentially concerned could have the time period AI seem 52 instances of their convention calls.

AI is right here and it‘s highly effective, however how can traders differentiate between the companies that really profit and people which can be simply clinging on to a development?

I suggest two easy and easy-to-follow guidelines that enable an investor to take part with out getting swept up within the mania:

- Keep on the income facet of AI

- Persist with an affordable valuation

Plenty of firms speak about how they’re investing of their AI capabilities. That is a cost-line merchandise that hopefully will pan out sometime. Or it could possibly be one other metaverse.

Recall that shortly after the pandemic, individuals appropriately predicted that videoconferencing could be the way forward for enterprise.

Zoom Communications (ZM) shot up a whole bunch of p.c to round $600. However then it grew to become clear that regardless of them having a wonderful platform, monetization was all the time going to be tough.

SA

I feel most of the AI merchandise will endure an identical destiny. Many firms will construct helpful and even perhaps broadly adopted instruments, however monetization and margins are questionable.

I’m not suggesting that firms received’t achieve success in promoting AI, however slightly that it is a huge unknown. Many will fail, and some will succeed.

A Extra Dependable Option to Put money into AI

Quite than making an attempt to make one thing with AI after which promote it, different firms promote the foundational infrastructure that makes AI attainable. I name this the income facet of AI, as a result of the revenues are already flowing,

I am actually not the primary to note this distinction, because the market has already bid up many and even many of the revenue-side shares.

- Chips

- IPPs (impartial energy producers)

- Nuclear vitality producers

NVDA and its chip friends have dominated the market.

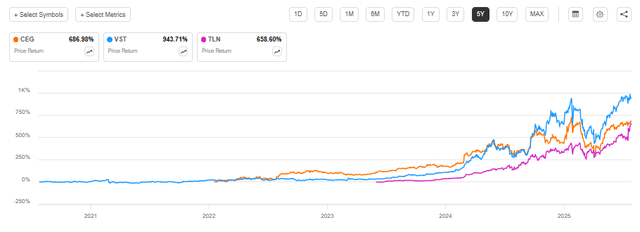

The impartial energy producers, Constellation (CEG), Vistra (VST), and Talen (TLN), proven under, are up 650% to 950%.

SA

Something within the nuclear provide chain is hovering on hopes that it is the dependable energy to gasoline AI.

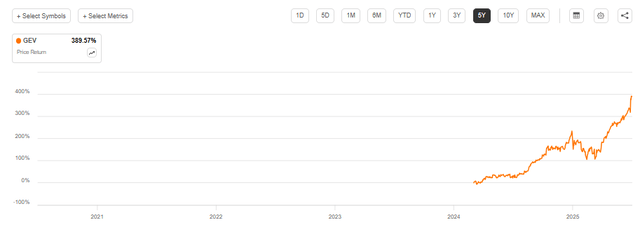

GE Vernova (GEV) is maybe the poster little one for the vitality infrastructure increase.

SA

Every of those classes has had reputable basic success.

The newest PJM public sale exhibits considerably elevated costs, which can additional bolster the earnings of the impartial energy producers.

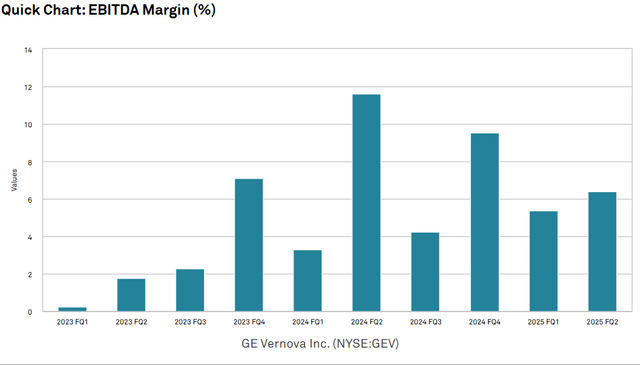

GEV’s margins have elevated considerably, and there may be hypothesis they are going to rise to the mid-teens.

S&P International Market Intelligence

I wrote about and acquired GEV shortly after its spin-off. It was an ideal place for me, however I offered too early and now have a wholesome dose of vendor’s regret.

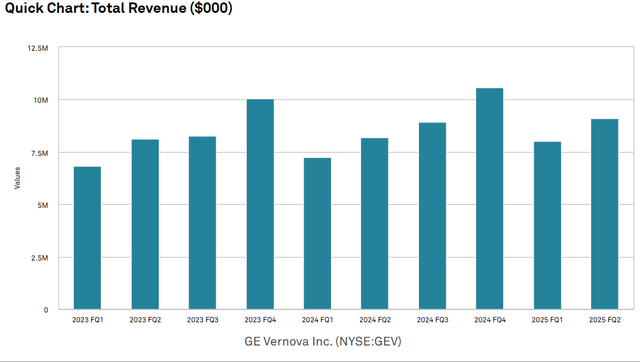

GEV’s revenues have elevated steadily together with the margins.

S&P International Market Intelligence

Income development in tandem with margin enlargement has a multiplicative affect on earnings. Nevertheless, even sturdy earnings development couldn’t preserve tempo with the explosive market value.

GE Vernova now trades at 87X ahead earnings. The remainder of the actually sizzling revenue-side AI shares comply with the identical sample—sturdy earnings development that hasn’t saved tempo with inventory value.

This leaves them buying and selling at lofty multiples:

- CEG – 35X ahead

- VST – 28.6X ahead

- TLN – 58.1X ahead

- NVDA – 40.1X ahead

These multiples might not appear that top in comparison with the S&P, however take into account that these shares are in sectors which have traditionally been fairly cyclical.

A cyclical inventory ought to commerce at its highest a number of on the trough of the cycle and its lowest a number of on the peak of the cycle. Thus, to justify multiples this excessive, one must consider that these firms are nearer to the trough than the height. Given the explosive earnings development they’ve already skilled, I discover that tough to consider.

It is attainable the AI wave is so highly effective that these industries are now not cyclical and have been launched into secular development. That‘s the kind of conviction one would wish for funding at as we speak’s costs to be justified.

As an alternative, I feel there are extra dependable features available within the pockets of the income facet of AI that haven’t but been bid to the moon.

Worth Performs on the Income Facet of AI

We take into account regulated utilities to be the perfect mixture of worth and development for collaborating in AI. They don’t seem to be usually thought of AI names, so enable me to elaborate on how they profit by contrasting them with the IPPs mentioned earlier.

The impartial energy producers take part in market costs of dependable further electrical energy, so that they straight and swiftly profit from the spike in PJM public sale costs.

The swiftness has made their earnings spike and, for my part, oversubscribed by inventory market costs.

Regulated electrical utilities expertise an identical demand spike, however as a result of their closely regulated nature, they are much slower to reply.

These subsequent few years can be an fascinating timeframe in which there’s an amazing imbalance in vitality markets. The demand for electrical energy ramped up quickly, whereas the manufacturing of extra electrical energy is a course of that takes as much as 5 years. Allowing, regulating, and bodily constructing new vegetation all take a very long time.

Throughout this window of imbalance, the IPPs and suppliers like GEV are reaping the vast majority of advantages. Nevertheless, as time goes on and provide catches as much as demand, it is going to be the regulated utilities that take pleasure in long-term increased earnings.

Incremental demand for electrical energy has manifested in huge pipelines for nearly the entire regulated electrical utilities. They’re putting in plans to considerably develop their manufacturing and transmission infrastructure base over the following decade. Most of their pipelines are between 50% and 200% of the market cap of every firm.

As this infrastructure is constructed, the speed base of every utility will increase, and its earnings improve proportionally with the speed base. A lot of the utilities are actually projecting long-term annual earnings development within the 6%-9% vary.

This may not sound like a lot, significantly because the S&P has lately been rising a bit greater than that. Nevertheless, there are two elements that I feel are being neglected by the market.

- 6%-9% development is much more for firms that don’t actually have unfavorable development intervals

- Valuation

Throughout development phases, the S&P may develop at a double-digit tempo, nevertheless it additionally has intervals the place it has substantial unfavorable development. Thus, a portion of its development throughout the good instances is simply making up for beforehand misplaced development.

Electrical utilities are completely different as a result of they’ve largely prevented recessions. Thus, every 6% to 9% development they put up is towards document excessive development. The expansion is recent, incremental development slightly than a portion of it making up for earlier losses.

So actually, the S&P is barely rising quicker in nominal phrases when a interval that occurs to be throughout an upswing.

The 6%-9% annual development price utilities are positioned to take pleasure in over the following decade, together with their dividends, considerably outperforms the long-term returns of the S&P.

Valuation

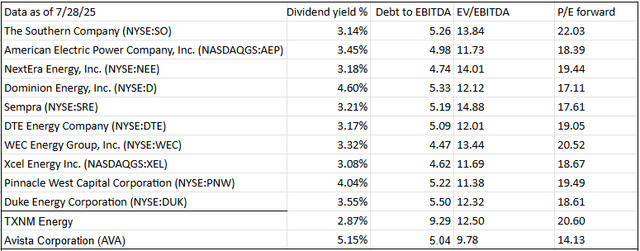

As electrical utilities have not likely been thought of a part of AI regardless of the large spike in electrical energy demand that outcomes, market costs have remained low. Your complete sector is buying and selling at a major low cost to the broader market.

2MC

Between discounted valuation and excessive sustainable development, I feel regulated electrical utilities will outperform the market.