Digital asset funding agency Galaxy Digital (GLXY) mentioned on Friday it agreed to a $460 million personal funding from one of many world’s largest asset managers, a deal that may add money for its rising information heart enterprise and basic company wants.

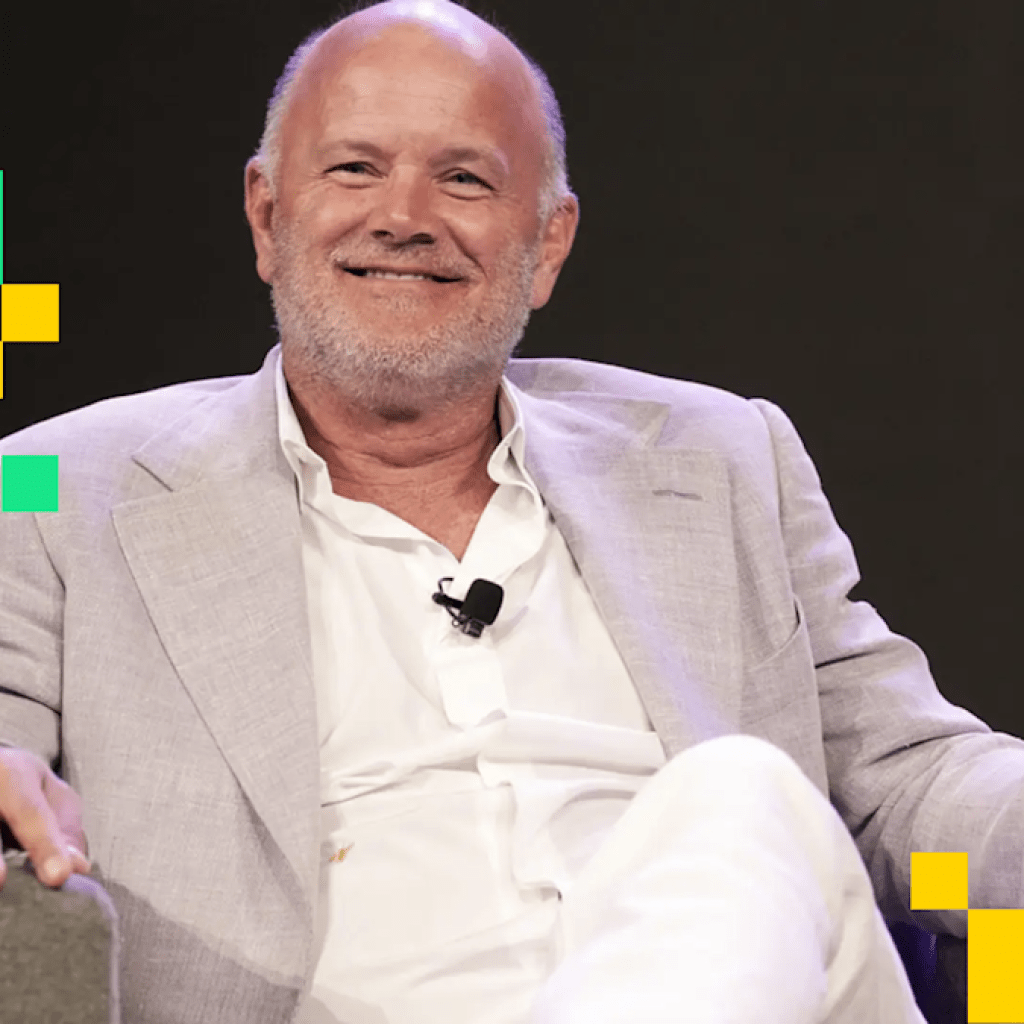

The funding, from the undisclosed agency, is break up between 9,027,778 new Class A shares issued by Galaxy and three,750,000 shares bought by sure executives, together with founder and CEO Mike Novogratz, at $36 per share, in response to the press launch. That is an 8.5% low cost from Friday’s closing worth.

“Strengthening our steadiness sheet is important to scaling Galaxy’s information heart enterprise effectively whereas sustaining the monetary flexibility to assist future development,” mentioned Novogratz. “

Having one of many world’s largest and most subtle institutional buyers make such a big funding in our firm will assist our strategic imaginative and prescient and our potential to construct main companies throughout digital belongings and information facilities.”

The transaction is slated to shut on or about October 17, topic to customary circumstances, together with approval by the Toronto Inventory Trade.

The agency mentioned the funds will assist construct out its Helios information heart campus, which is scheduled to ship 133 megawatts of essential IT load within the first half of 2026 below its Section One lease.

Galaxy purchased Helios from struggling miner Argos in 2022 to function as a mining operation. Nonetheless, as bitcoin mining turned more and more troublesome with skinny margins, Galaxy, like many different miners, pivoted its mining operations in the direction of an information heart for AI and HPC computing.

Since then, Galaxy has been more and more investing in Helios to quickly broaden and reinvent it as an AI and HPC internet hosting information heart.

The brand new deal comes after Galaxy introduced this summer season that it had secured $1.4 billion in funding to broaden Helios. That deal adopted a lease settlement with AI cloud supplier CoreWeave (CRWV), which has now dedicated to all 800 megawatts of accepted energy capability at Helios.

This AI push by Galaxy has been a welcome growth out there, as buyers and analysts view the pivot as a transfer that might add extra worth to the inventory. Galaxy shares jumped 3% in post-market buying and selling on the information of the brand new deal.

Learn extra: The Bull Case for Galaxy Digital Is AI Knowledge Facilities Not Bitcoin Mining, Analysis Agency Says