Kagenmi/iStock by way of Getty Photos

By Garey J. Aitken, CFA & Timothy W. Caulfield, CFA

Cyclical Power Sparks Canadian Rally – Market Overview

Canadian equities continued their advance within the third quarter regardless of ongoing world commerce uncertainty and geopolitical dangers within the Center East. The S&P/TSX Composite Whole Return Index (TRI) jumped 12.5%, reaching a brand new all-time excessive on the ultimate day of the quarter. Power in Canadian equities was broad based mostly, with new data set by seven of 11 Canadian GICS sectors: vitality, supplies, industrials, client discretionary, client staples, financials and utilities. Notably absent from this checklist had been data expertise (IT), well being care, communication companies and actual property, which have but to get well to earlier highs.

The U.S. greenback recovered from a few of its prior-quarter decline in opposition to the Canadian greenback, rising 2.3% within the third quarter to $1.39 USD/CAD, although it stays down 3.2% yr up to now. Whereas a softer U.S. greenback usually reduces the translated worth of U.S.-based earnings, the influence on Canadian equities is extra nuanced, significantly given its affect on commodity markets equivalent to gold and copper. Heightened coverage uncertainty from the U.S. administration, starting from commerce measures that weaken the greenback’s “secure haven” standing to issues over fiscal deficits and mounting debt, has added one other layer of volatility.

In Canada, the persistence of U.S. tariffs has sustained uncertainty relating to the momentum of future financial exercise, with outcomes hinging on how intensive and extended the commerce dispute proves to be. Canada’s economic system displayed modest enchancment in July, with GDP progress tempered by still-elevated unemployment and subdued inflation. General, Canada’s third-quarter macro backdrop mirrored barely higher sentiment in comparison with the second quarter, although situations for equities remained nuanced. Benchmark 10-year yields slipped, down 9 foundation factors to three.18%, nicely beneath their October 2023 highs of 4.24%. On each side of the border, anticipated financial easing materialized, typically seen as supportive for equities. Each the Financial institution of Canada and the Federal Reserve delivered fee cuts within the quarter, with the Financial institution of Canada now reducing charges eight instances this cycle to a impartial 2.50% to stimulate housing and consumption.

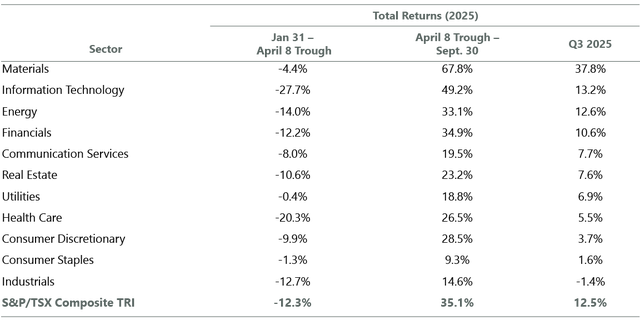

On an absolute return foundation, the Canadian fairness market’s advance was broad based mostly, with 10 of 11 GICS sectors having elevated within the third quarter. Supplies (+37.8%), IT (+13.2%) and vitality (+12.6%), had been the three best-performing sectors. In the meantime, industrials (-1.4%), client staples (+1.6%) and client discretionary (+3.7%) had been the worst performers. In supplies, surging commodity costs drove sturdy positive aspects for gold producers, with extra assist coming from strong efficiency in copper producers. In IT, Canadian tech shares continued a unstable however finally constructive wave. The worldwide tech rally, particularly U.S. mega-cap tech and perceived winners and losers of synthetic intelligence (AI), spilled into the Canadian market to a level.

In vitality, energy throughout producers, infrastructure and companies was seen regardless of the volatility in crude oil and pure fuel costs that ended the quarter at US$62.37/bbl (West Texas Intermediate) and US$3.30/mmbtu (NYMEX). This represented a 4.2% and 4.4% lower in oil and pure fuel, respectively. Positive factors got here from enhancing sentiment pushed by the brand new Carney Liberal authorities’s extra constructive stance towards the sector, which ought to assist simpler allowing and approval of latest egress choices for the basin. Improved market entry for the commodities would result in higher realized costs for producers and make future progress plans extra palatable to traders.

Weak point within the Canadian rails weighed closely on industrials efficiency. Shopper-oriented sectors additionally lagged, though a number of discretionary shares with cyclical publicity rebounded from the earlier quarter’s lows following heightened commerce tensions and tariff issues after Liberation Day. This was tempered by diminished sentiment for the defensive pockets of the market, like client staples, which declined as traders favored riskier property.

Efficiency Overview

The ClearBridge Canadian Fairness Technique underperformed the benchmark within the third quarter. The Technique’s cyclical publicity was a main detractor, most notably in supplies. Gold bullion continued its ascent within the third quarter, ending at US$3,873 per ounce, up 17.1% within the quarter and 46.6% yr up to now. As is usually the case provided that we wrestle to search out gold-related equities with the requisite fundamentals or valuations, the Technique is meaningfully underweight the gold subindustry, which ended the quarter with a 12.7% weight within the index. The Technique’s gold-related holdings, Agnico Eagle Mines (AEM) and Franco-Nevada (FNV), had been each sturdy performers year-to-date.

In industrials, Canadian Nationwide Railway (CNI) and Canadian Pacific Kansas Metropolis (CP) collectively account for roughly 35% of the sector benchmark; each had been pressured by softer delivery volumes, commerce uncertainty and lingering macroeconomic headwinds inflicting each corporations to decrease steerage in 2025.

In vitality, commodity worth volatility and weak spot resulted in poor efficiency for our holdings. Stronger efficiency from Parex Assets (OTCPK:PARXF) and Cenovus Vitality (CVE) was not sufficient to offset weaker general efficiency from our pure gas-focused producers, ARC Assets (OTCPK:AETUF) and Tourmaline (OTCPK:TRMLF).

In IT, bigger detractors included our underweight positioning to sector chief Shopify (SHOP), underperformance from CGI (GIB) and never proudly owning the outperforming Celestica (CLS). Shopify noticed sturdy momentum in parallel to U.S. giant cap expertise shares, with continued sturdy execution and an introduced partnership with OpenAI (OPENAI) serving to shares. Celestica, a uncommon AI play in Canada (hardware-oriented), continues its march increased as spending on information heart infrastructure and demand from hyperscalers created tailwinds.

Financials was the Technique’s finest contributor within the third quarter. Sturdy safety choice got here from not proudly owning underperforming Solar Life Monetary (SLF) and Fairfax Monetary (OTCPK:FRFHF), in addition to an chubby in Financial institution of Montreal (BMO). The big Canadian banks as a complete noticed sturdy efficiency within the third quarter: BMO saved tempo with friends because the outlook for credit score losses moderated, capital markets exercise rebounded and extra capital positions enabled return on fairness enhancements by way of buybacks.

Portfolio Positioning

4 holdings had been concerned in company actions through the quarter. Parkland Corp. (OTCPK:PKIUF) introduced a definitive settlement within the second quarter to be acquired by Sunoco LP (SUN) in a cash-and-equity transaction. With the market worth reflecting a balanced threat/reward post-offer, we exited our place. MEG Vitality (OTCPK:MEGEF) grew to become the topic of an unsolicited bid from Strathcona Assets (OTCPK:STHRF), which was rejected by MEG’s board as insufficient. Cenovus, one other of our holdings, subsequently made a competing supply, seen as strategically superior and with a extra balanced threat profile. Through the earlier quarter, TELUS Digital bought its first non-binding proposal from its mother or father firm, TELUS, which was subsequently improved. Because the deal was solidified, we exited our place. Lastly, Teck Assets and Anglo American agreed to a merger of equals that will create a world mining chief with 70% copper publicity and significant synergies from adjoining property, although the timeline, curiosity from third events and consent from the Canadian authorities stay unsure.

Buying and selling exercise within the Technique picked up because the atmosphere offered compelling alternatives to each scale into and pare again positions. We selectively elevated publicity to a number of out-of-favor cyclical shares that confronted important stress, whereas on the identical time trimming resilient defensive sectors, together with client staples and utilities. By including higher-beta publicity on weak spot and lowering lower-beta holdings on energy, the general consequence was an intentional tilt towards higher “threat” at enticing valuations, lifting the Technique’s ex-ante beta to barely above the midpoint of the 0.8 to 0.9 goal band. Though turnover is normally modest, we stay ready to behave decisively every time situations create compelling entry or exit factors.

In financials, we initiated a place in EQB (OTCPK:EQGPF) and added to our current positions in Manulife Monetary and Intact Monetary. For EQB, following the surprising passing of long-term CEO Andrew Moor, which elevated volatility and led to share worth weak spot within the quarter, we had been capable of provoke a place at a lovely entry level. EQB is Canada’s main digital-first financial institution, delivering above-average progress by way of progressive on-line banking, mortgages and business lending. Its asset-light, technology-driven mannequin permits it to function with decrease prices and better effectivity than conventional friends. The corporate has delivered sturdy earnings progress and a excessive return on fairness, supported by prudent threat administration and increasing buyer adoption.

In utilities, we exited our remaining place of ATCO (OTCPK:ACLLF) on share worth energy, noting that we’ve got beforehand constructed a place in Canadian Utilities, an working subsidiary of the corporate and its largest funding as we thought of it to be comparatively extra attractively valued. Competitively positioned in its core markets, Canadian Utilities has established a robust monitor document of operational excellence, producing increased returns than regulatory allowances. The corporate is well-positioned to leverage its asset base, business experience and partnerships to advance each its strategic and monetary aims.

In actual property, we exited our remaining place in Allied Properties (OTC:APYRF). The corporate continues to face a troublesome Canadian workplace market, characterised by elevated emptiness charges and subdued leasing demand, even earlier than factoring within the added uncertainty from tariffs. Throughout this era of sustained weak spot, Allied expanded its stability sheet by buying properties and associated mortgages from a three way partnership companion that was unable to service its debt. To handle the upper leverage, the corporate plans to pursue asset inclinations, although this comes at the price of future improvement and progress potential. Rising curiosity bills mixed with tender leasing tendencies are anticipated to weigh on earnings going ahead.

At quarter finish, the Technique’s largest sector exposures had been financials, industrials and vitality. Relative to the benchmark, the Technique is chubby the industrials sectors and the widely defensive/non-cyclical client staples and utilities. The Technique is most underweight the usually worth/cyclical supplies and financials sectors.

Technique and Outlook

Canadian fairness markets continued to construct on year-to-date energy within the third quarter, supported by resilient company earnings and a backdrop of shifting world dynamics. Whereas political uncertainty within the U.S. beneath the Trump administration created volatility throughout asset courses, the Canadian fairness market, in addition to our Technique extra broadly, delivered sturdy absolute returns. Towards this backdrop, sector management has remained concentrated, with supplies and IT capturing investor consideration. Investor sentiment, although cautious, has proven indicators of resilience as macro headwinds and political dangers are more and more priced into expectations.

Exhibit 1: Tariff Dangers Sparked Curler Coaster Journey Throughout Sectors

As of Sept. 30, 2025. Supply: ClearBridge Investments, FactSet.

In instances of market uncertainty, such because the unpredictability of the present U.S. administration, it’s important to take care of a long-term perspective. Avoiding short-term distractions and remaining decisive within the face of each dangers and alternatives is vital. This features a disciplined strategy to valuation, guided by discounted money stream evaluation, with an emphasis on equities buying and selling at a significant low cost to our estimate of intrinsic worth. We concentrate on high-quality corporations with clear potential for future profitability, sustainable long-term progress, prudent capital allocation and a balanced risk-reward profile. We proceed to emphasise predictability and draw back safety whereas sustaining affordable valuations. This strategy helps portfolio stability and outperformance during times of market volatility, whereas permitting flexibility to seize creating alternatives.

Portfolio Highlights

Through the third quarter, the ClearBridge Canadian Fairness Technique underperformed its S&P/TSX Composite TRI benchmark. On an absolute foundation, the Technique generated positive aspects in eight of the ten sectors wherein it was invested (out of 11 whole). The first contributors had been the financials, supplies and IT sectors, whereas the principle detractor was industrials.

Relative to the benchmark, general inventory choice and sector allocation detracted from efficiency. Specifically, an underweight to supplies, overweights to industrials and client staples and choice in supplies and vitality had essentially the most damaging impacts. On the constructive facet, choice in financials, client staples and actual property and underweights to financials and client discretionary contributed to efficiency.

On a person inventory foundation, main relative contributors included Franco-Nevada, Constellation Software program and Open Textual content and never holding Thomson Reuters and Solar Life Monetary. High relative detractors included Canadian Nationwide Railway, Shopify and CGI and never holding Barrick Mining and Kinross Gold.

Garey J. Aitken, CFA, Managing Director, Head of Canadian Equities, Portfolio Supervisor

Timothy W. Caulfield, CFA, Managing Director, Director of Canadian Equities Analysis, Portfolio Supervisor

|

Previous efficiency isn’t any assure of future outcomes. Copyright © 2025 ClearBridge Investments. All opinions and information included on this commentary are as of the publication date and are topic to alter. The opinions and views expressed herein are of the creator and should differ from different portfolio managers or the agency as a complete, and will not be meant to be a forecast of future occasions, a assure of future outcomes or funding recommendation. This data shouldn’t be used as the only real foundation to make any funding determination. The statistics have been obtained from sources believed to be dependable, however the accuracy and completeness of this data can’t be assured. Neither ClearBridge Investments, LLC nor its data suppliers are liable for any damages or losses arising from any use of this data. Efficiency supply: Inner. Benchmark supply: Commonplace & Poor’s. |