Commodity Futures Buying and selling Fee Appearing Chair Caroline Pham discusses the ‘crypto dash’ initiative, how regulation may strengthen U.S. management in digital property and the market influence of President Donald Trump’s commerce insurance policies.

The dominant narrative round President Trump’s pardon of Binance founder Changpeng Zhao (“CZ”) is one phrase: corruption. You may see it within the speaking factors:

- Rep. Maxine Waters: “The pardon… a blatant instance of pay-to-play corruption.”

- Tommy Vietor: “Trump’s crypto firm made a multi-billion-dollar deal in partnership with Binance, so Trump gave the founder a pardon.”

- Sen. Ruben Gallego: “It’s corruption on full show.”

From these traces, you’d suppose Binance and CZ have an energetic enterprise relationship with the Trumps. They don’t. That declare is unsubstantiated. There aren’t any receipts as a result of there’s no deal to point out.

What Really Occurred—and Why Individuals Are Confused

Earlier this 12 months, Binance introduced a $2 billion funding from MGX—a landmark deal and the primary institutional funding for the world’s largest crypto change. I mentioned it with CEO Richard Teng on the DC Blockchain Summit in March.

The place the plot will get twisted: MGX’s funding was funded in USD1, a stablecoin issued by World Liberty Monetary, Inc. Public reporting signifies the Trump household holds a minority stake in World Liberty Monetary by way of DT Marks DeFi LLC. USD1 is multichain, with deployments on BNB Chain and Ethereum.

What That Does Not Imply

Paying in USD1 doesn’t create a enterprise partnership between Binance/CZ and the Trump household.

A token working on BNB Chain doesn’t suggest a industrial relationship with Binance; BNB Chain is an open blockchain anybody can construct on.

The one “receipt” right here: DT Marks DeFi LLC → minority curiosity in WLF → WLF points USD1 → USD1 exists on BNB Chain/Ethereum → MGX used USD1 within the Binance deal.

That chain of information doesn’t set up a Trump–Binance/CZ partnership, and it doesn’t show the pardon was quid-pro-quo. It exhibits instrumental use of a public-chain stablecoin, not a personal enterprise association. By that logic, shopping for bourbon with U.S. {dollars} would make you a enterprise accomplice of the U.S. authorities—or of Kentucky. If anybody has onerous proof of a direct Trump–CZ/Binance enterprise deal, current it. Till then, this storyline is conjecture dressed up as certainty.

TRUMP PARDONS FORMER BINANCE CEO

Changpeng Zhao, CEO of Binance, speaks on the Delta Summit, Malta’s official Blockchain and Digital Innovation occasion selling cryptocurrency, in St Julian’s, Malta October 4, 2018. REUTERS/Darrin Zammit Lupi ( REUTERS/Darrin Zammit Lupi / Reuters Photographs)

What the Case In opposition to CZ Actually Was—and Wasn’t

The document exhibits:

CZ pleaded to a single, non-fraud Financial institution Secrecy Act (BSA) depend: failure to implement an efficient AML (anti-money laundering) program.

The courtroom document doesn’t set up that CZ knowingly facilitated illicit transactions.

In comparison with how main banks have been handled for much extra critical AML failures (billions in penalties, no comparable senior-executive jail sentences), the result right here was extraordinary for a first-time offender on a standalone BSA program failure.

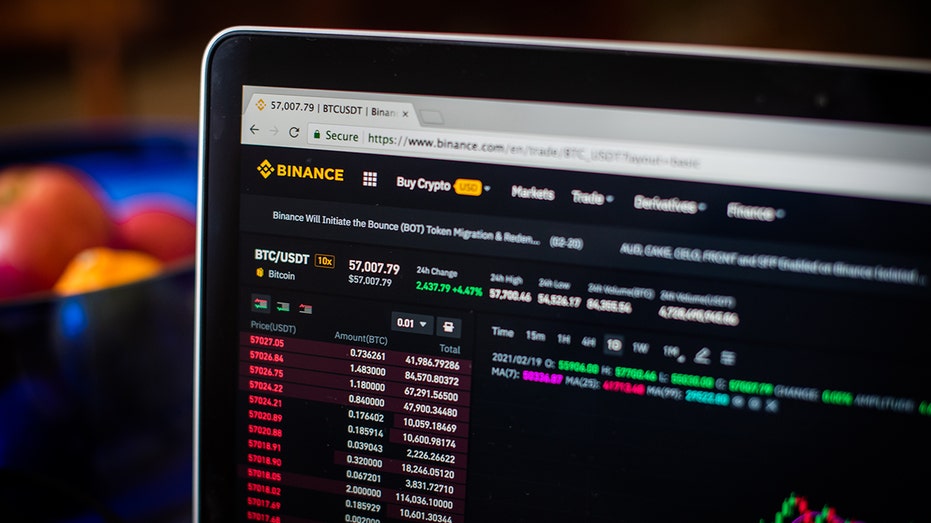

The Binance Change web site on a laptop computer laptop organized in Dobbs Ferry, New York, U.S., on Saturday, Feb. 20, 2021. Bitcoin has been battered by destructive feedback this week, with long-time skeptic and now Treasury Secretary Janet Yellen saying at (Getty / Getty Photographs)

You may dislike crypto, CZ, or the pardon. However let’s argue from the document we even have, not the one some want existed.

LIVE CRYPTO PRICES: HERE

Why the “Corruption” Body Is So Handy

The “pay-for-pardon” accusation does two political jobs without delay: it assaults a rival and sustains an anti-crypto narrative. It’s useful in case your objective is to stall U.S. crypto coverage—simply as Congress is lastly near passing market-structure laws. America ought to need lawful, clear, aggressive crypto markets to exist right here, not abroad. That requires guidelines, not innuendo.

Let’s Get to the Actual Debate

Transfer coverage ahead. If the U.S. needs to be the worldwide crypto capital and shield American retail buyers, we want clear, compliant pathways for main crypto corporations to function right here—together with Binance—below rigorous oversight.

This pardon corrects a disproportionate final result. CZ is a builder who helped create the world’s largest crypto change and, for years, has been handled as a political proxy in a broader struggle over digital property.

We want laws, not lawfare. And we should always cease pretending that utilizing an open blockchain creates a secret partnership—not more than paying a invoice in {dollars} makes you a shopper of the U.S. Treasury.

BLACKROCK’S BRAGGING RIGHTS FOR FASTEST GROWING ETFS

The trail to management: laws, not viral narratives; accountability, not guilt by affiliation. Guidelines. Readability. Competitiveness. And an open door to one of the best builders on this planet.

Perianne Boring is an American crypto advocate, investor, and founder. She is the Founder and Chair of The Digital Chamber, the nation’s oldest and largest blockchain commerce affiliation; a Associate at Off the Chain Capital; and the chief producer of the documentary God Bless Bitcoin.