Tashatuvango/iStock through Getty Photographs

Pricey Appleseed Fund Shareholders:

“[Gold] may simply go to $5,000, $10,000 in environments like this. This is among the few instances in my life the place it’s semi-rational to have some in your portfolio.”─ Jamie Dimon, JPMorgan Chase (JPM) CEO, 10/15/25

With the gold worth touching $4,250/ounce as we write this letter, the top of the start of the present gold bull market seems to have arrived. Higher late than by no means, Jamie Dimon and former PIMCO CEO Mohamed El-Erian are attempting to clarify why the worth of gold has surged 60% year-to-date, with 2025 representing the most effective calendar-year efficiency (to date) for gold since 1979. We started offering Appleseed Fund (APPLX) shareholders with gold publicity beginning in 2007, when it was clear to us {that a} historic housing bust was coming and {that a} associated main monetary disaster was looming, requiring a U.S. authorities bailout financed by newly-printed cash. The typical closing worth for gold that yr was $833.60/ounce. Since then, the gold worth has risen by virtually 6x, with a few tough pullbacks alongside the way in which, together with an virtually 30% decline within the worth of gold throughout 2013, a yr when the S&P 500 Index appreciated by greater than 30%.

Within the face of our materials valuable metals publicity, shareholders are asking us, “The place do you see gold going from right here?” Within the quick time period, our trustworthy reply is that we don’t know. If gold can improve in worth by 10% over a two-week interval, it may possibly additionally decline in worth by 10% over a two-week interval; our short-term crystal ball stays cloudy. We might add that gold appears overbought on a short-term foundation, which implies that it might be unsurprising if gold’s worth had been to have a correction of some magnitude or consolidate over a multi-month interval. Nonetheless, we entered the 2020s anticipating gold to outperform all different asset lessons (which it has), and we anticipate that outperformance to proceed by way of the steadiness of this decade.

And we are saying that as a result of, within the present surroundings, we predict continued Federal deficit spending largesse, financed by the Federal Reserve’s day-and-night dollar-printing machine, solely at a far larger degree than what occurred in the course of the Nice Monetary Disaster (GFC). Moreover an unprecedented quantity of Federal deficit spending, we have now extra causes to stay long-term bullish on gold, even at $4,250/ounce, regardless of a couple of new dangers we couldn’t have fathomed again in 2007.

Certainly, we consider there are 10 good causes that trigger us to stay bullish on the worth of gold, which we share beneath:

- Overseas central banks proceed to purchase gold aggressively. Earlier than the GFC of 2008-2009, overseas central banks as a gaggle had been internet sellers of gold. U.S. Treasury bonds had been thought-about to be nearly as good as gold or higher, and central banks gathered Treasuries as their major overseas reserve asset. By 2009, central banks turned involved in regards to the U.S. authorities’s response to the GFC, after seeing the U.S. authorities kick the proverbial can down the street by bailing out failing banks and avoiding the tough resolution to restructure the U.S. banking system. Overseas central banks have been internet patrons of gold ever since, whatever the worth, they usually have been internet sellers of U.S. Treasuries since 2014. Then, in 2022, after the USA confiscated Russia’s U.S. Treasury bond holdings in response to Russia’s invasion of Ukraine, overseas central banks accelerated their purchases of gold as a reserve asset. We consider overseas central banks accelerated their gold purchases as a result of they had been and proceed to be nervous about what may occur to their U.S. Treasury bonds ought to their respective nations anger the USA.

- Inflation stays persistent and appears to be accelerating. The Client Worth Index, our greatest measure of annual inflation regardless of its many flaws, has remained persistently above the Federal Reserve’s aim of two% for the final 5 years, peaking at over 9.1% in June 2022. Furthermore, we consider that inflation will doubtless re-accelerate quickly, as a consequence of a depreciating greenback, excessive ranges of fiscal deficit spending, vital commerce tariffs, and declining rates of interest. In environments the place inflation is excessive and accelerating, buyers have a tendency to hunt out property which can be scarce and liquid, and gold gives buyers loads of each qualities.

- The relative geopolitical and financial energy of the USA is declining. The U.S. greenback turned the world’s reserve forex within the aftermath of World Battle II when the USA stood because the world’s solely hegemon, each economically and militarily. In the present day, the USA’s share of worldwide Gross Home Product (GDP) has fallen to only 12.7%, versus 35% in 1944 when Bretton Woods was signed and when most currencies had been pegged to the U.S. greenback. As well as, the U.S. army appears to be pulling again from lots of its world commitments, whereas its weapons methods have change into more and more depending on a provide chain of uncommon earth metals imported from China, certainly one of its principal adversaries. As the ability of the USA has waned whereas China’s has waxed over the previous a number of many years, nations have change into extra comfy buying and selling in native currencies with out worrying about catastrophic financial or army repercussions.

- Gold has change into extra helpful as a impartial reserve asset. Traditionally, worldwide commerce commenced largely in U.S. {dollars}, however at the moment an rising share of world commerce is carried out in native currencies, with any imbalances settled in gold. As a result of gold is a naturally occurring steel, not a fiat forex whose provide of printed paper is managed by any single authorities, it’s trusted as a reserve asset by nations all over the place. Nonetheless, it stays problematic that world commerce is so huge relative to the present worth of gold that central banks personal. We consider this downside is more likely to be solved by central banks shopping for gold so as to add to their steadiness sheets (see Motive #1 above) and by the worth of gold rising relative to all the pieces traded between nations, which is precisely what is occurring. For instance, the gold/oil (ounce-of-gold-to-barrel-of-oil) ratio is at present over 65x, effectively above the typical 15x ratio that existed earlier than central banks resumed shopping for gold.

- Gold is severely under-owned by Western buyers. In comparison with Asian buyers, Western buyers choose proudly owning shares and bonds to gold. A lot of this choice outcomes from the steady and constructive returns that Western buyers have derived from bonds over the previous 40 years. Most funding managers as a matter of coverage is not going to suggest a gold allocation to their shoppers, largely as a result of no one else does so and it’s professionally dangerous to stray too distant from the group. With gold’s worth persevering with to climb upwards, strategic allocation selections will doubtless change, however it hasn’t occurred but. Furthermore, in response to UBS (UBS), U.S. household workplaces have a strategic asset allocation to commodities of simply ~1%. When monetary advisors and household workplaces start to allocate ~20% of their shoppers’ portfolios to gold, as Morgan Stanley’s (MS) Chief Funding Officer Mike Wilson simply really useful for the primary time final month, the demand for gold will essentially improve markedly, and, with gold’s provide shortage, we consider the worth of gold will essentially have to extend, too.

- Bodily gold shops within the West are low and declining. Monumental portions of bodily gold have been transferring from the West to the East for a few years. In consequence, gold ounces have been accumulating in China, India, and Russia, whereas gold inventories have been declining in London and in Switzerland, the place institutional bars of gold have traditionally been refined and saved by Western buyers. When bodily gold shops change into low sufficient, it’s doubtless that the gold worth shall be squeezed excessive sufficient to influence long-term holders of bodily gold to promote. Such bodily shortages have begun surfacing this month amongst sure retail buyers, however not but amongst institutional buyers.

- The Debt/GDP ratio worldwide has by no means been greater. The USA, Europe, Japan, and China have report ranges of indebtedness. For the USA, Europe, and Japan, it’s a government-debt downside, whereas for China, it’s extra of a local-government and state-owned-enterprise debt downside. For all these nations, nonetheless, their indebtedness issues might be alleviated by depreciating their respective currencies versus gold. This pure alignment allows coordinated coverage to help greater gold costs, accelerated inflation, and progressively enhancing debt ratios. It’s doubtless that the secular high within the gold worth is not going to be achieved till such debt ratios have declined considerably from present ranges.

- Belief is declining quickly. Belief is quickly declining between the USA and lots of different nations, and it’s also declining inside the USA. This lack of belief extends to many authorities establishments, together with the Federal Reserve, the U.S. establishment primarily answerable for regulating the financial provide and setting rates of interest. The gold worth tends to rise in periods of declining belief within the Federal Reserve. The Federal Reserve not too long ago introduced plans to scale back rates of interest additional, making the greenback much less enticing relative to different currencies and to gold, doubtless leading to one other spherical of accelerating inflation that would additional erode belief within the Federal Reserve.

- The Trump administration desires a decrease greenback. The USA has a big present account deficit as a result of it imports much more from the remainder of the world than it exports. The Trump administration is attempting to deal with this in a number of methods, together with encouraging different nations to permit the greenback to depreciate versus different currencies. Up to now in 2025, the greenback index has declined by about 10%, which implies that gold’s efficiency in {dollars} has been 10% higher year-to-date than gold’s efficiency within the currencies of different developed nations.

- Gold stays cheap relative to U.S. financial base. Regardless of the rising gold worth, gold stays fairly cheap relative to the U.S. financial provide. On the peak of the final gold bull market, the worth of the gold owned by the U.S. authorities represented greater than 120% of the financial base in 1981, greater than triple the long-term common of about 40%. By this measure, gold was clearly in a bubble in 1981, and its worth declined considerably over the next 20 years. In the present day, the worth of the gold owned by the U.S. authorities represents simply 15% of the U.S. financial base. Put otherwise, the worth of gold may virtually triple from the present worth earlier than reaching the historic common of 40%.

Having mentioned a few of the causes we’re bullish on gold, we need to clarify that gold is much from a risk-free funding. We see the first three dangers as being the next:

- Bitcoin might make gold technologically out of date. An rising variety of buyers are shopping for bitcoin and different cryptocurrencies as a retailer of worth, contemplating it “digital gold.” Whereas not tangible, bitcoin is scarce as a result of its provide is algorithmically restricted to 21 million (bit)cash, of which the bulk have already been mined. Simply as most individuals have opted for electronic mail over snail mail as a consequence of technological adjustments, it could be that bitcoin sometime replaces gold because the world’s premier retailer of worth.

- Miners may uncover a big new provide of gold. As AI expertise advances at an more and more speedy price, it may sometime change into economically possible to mine asteroids, the moon, or Mars for minerals, leading to an infinite improve within the provide of gold, considerably akin to the invention of gold within the New World in the course of the sixteenth Century. Such a discovery would end in decrease gold costs, all issues being equal.

- Governments may intrude with gold buyers’ capability to revenue from a rising worth. Very like what President Roosevelt did in the course of the Nice Melancholy, the U.S. authorities may select to confiscate investor gold. As well as, the U.S. authorities may apply extra punitive capital positive aspects tax charges to buyers who promote their gold for a big capital acquire.

Given the scale of Appleseed Fund’s gold positions, we’re carefully monitoring these and different dangers. We view the dangers talked about above as unlikely, however it’s however worthwhile to think about eventualities that would stop our shoppers from making the most of a rising gold worth going ahead. It might be that we select to trim a few of our gold positions, not as a result of we’re so nervous about these dangers, however to rebalance the portfolio as Appleseed Fund’s gold allocations have elevated in gentle of a ~60% rise in gold costs to date this yr.

Efficiency and Portfolio Adjustments

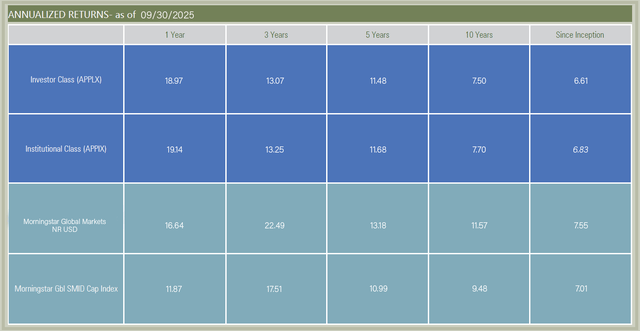

Over the 12 months ended 9/30/25, Appleseed Fund Institutional Class has generated an absolute return of 19.14%, outperforming the Morningstar International Markets Index, which generated a complete return of 16.64%. With lower than 70% of the Appleseed portfolio invested in shares, we discover the efficiency to be fairly robust on a risk-adjusted foundation. All through a lot of the previous a number of years, Appleseed Fund has been positioned for an inflationary, sluggish progress economic system. With inflation ranges falling, inflicting a ripping inventory market for the reason that finish of 2022, Appleseed’s cautious positioning held again funding returns.

The Fund’s previous efficiency doesn’t assure future outcomes. The funding return and principal worth of an funding within the Fund will fluctuate in order that an investor’s shares, when redeemed, could also be value kind of than their authentic price. Present efficiency of the Fund could also be decrease or greater than the efficiency quoted. Efficiency information present to the newest month finish could also be obtained by calling 1-800-470-1029

Appleseed Fund added a lot of new names to the portfolio up to now twelve months, together with Conagra (CAG), Chemours (CC), Easterly Authorities Properties (DEA), Diana Transport (DSX), GXO Logistics (GXO), Lululemon (LULU), Normal Chartered (STAN-GB), Two Harbors (TWO), NICE Ltd. (NICE), and Wal-Mart de Mexico (OTCQX:WMMVY). When it comes to portfolio gross sales, Appleseed Fund liquidated its holdings in SS&C (SSNC), Cameco (CCJ), Wesco (WCC), CNB Monetary (CCNE), Sony (SONY), Roche (OTCQX:RHHBY), Estée Lauder (EL), and AGNC (AGNC). All of those securities reached our estimates for intrinsic worth, and we took the capital and invested it elsewhere.

Throughout the fairness portion of the portfolio, the largest contributors to the Fund’s efficiency over the previous 12 months had been Lumentum Holdings Inc. (LITE) convertible bonds, Fannie Mae (OTCQB:FNMA) most well-liked equities, AerCap (AER), Cameco (CCJ), and bodily gold trusts. Essentially the most vital detractors to efficiency over the previous 12 months have been Boardwalk REIT (BEI.UT-CA), Bollore (BOL- FR), Stanley Black & Decker (SWK), Diana Transport (DSX), and Estée Lauder (EL).

When it comes to present asset allocation, with reference to equities, we’re favoring corporations within the client staples, healthcare, and agriculture sectors in addition to cheap, out-of-favor worth shares. Our publicity to corporations with bigger non-U.S. greenback denominated money flows has elevated materially up to now yr. We don’t consider that inflation is below management, as a lot of the long-term drivers of inflation are secular not cyclical and stay in place. The U.S. fiscal scenario wants the greenback down and inflation again as much as keep away from vital fiscal issues within the near-term.

Past equities, Appleseed Fund is obese bodily gold trusts, Fannie Mae most well-liked shares, and bodily uranium trusts. We thank Appleseed Fund shareholders for his or her continued help of us within the administration of their investable property.

Sincerely,Adam Strauss, CFAWilliam Pekin, CFAJoseph Plevelich, CFAShaun Roach, CFAJoshua Strauss, CFAAppleseed Fund Portfolio Managers

Prime 10 Holdings – as of 09/30/2025

Editor’s Be aware: The abstract bullets for this text had been chosen by Looking for Alpha editors.