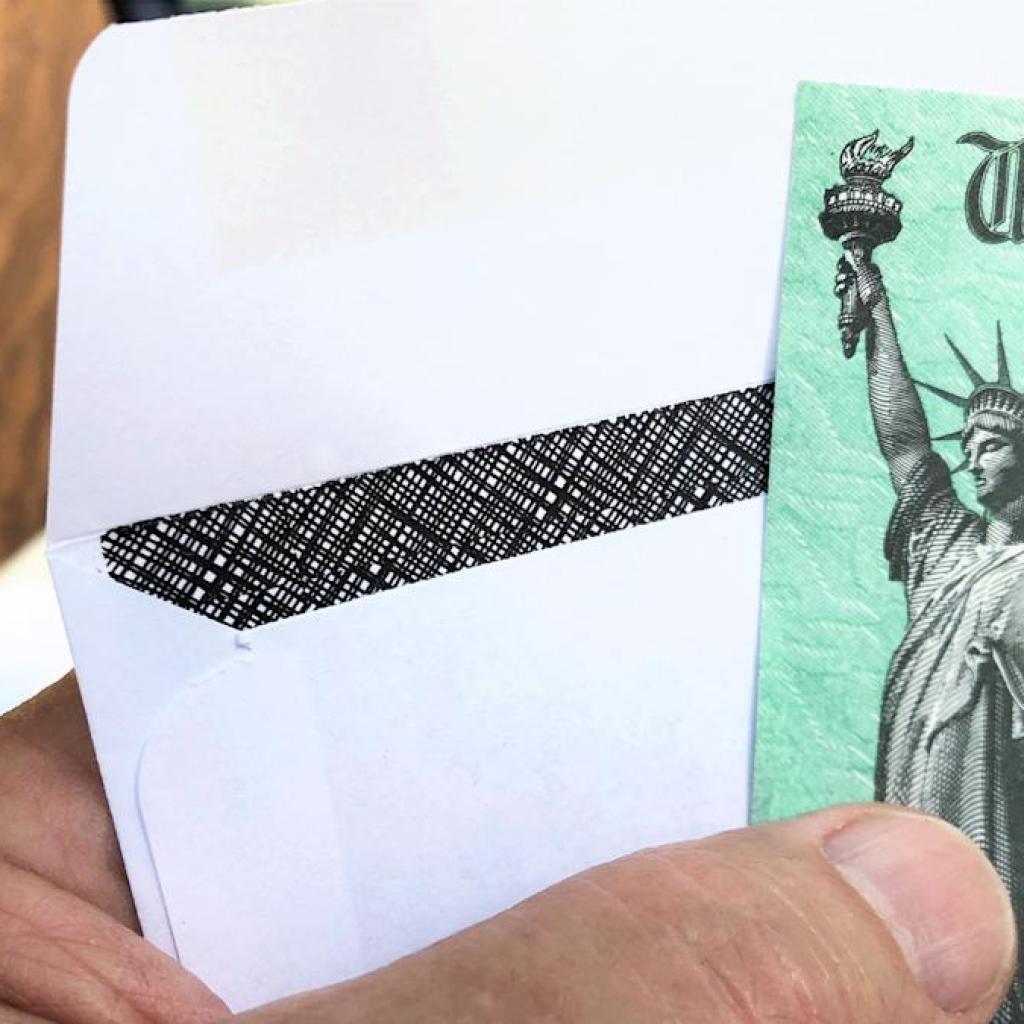

The Social Safety Administration (SSA) introduced an enormous change to this system beginning Sept. 30, 2025 — however don’t fear, it’s not a minimize to advantages. As a substitute, that’s the day that the SSA will cease issuing paper checks. This shift to fully digital funds isn’t meant to inconvenience beneficiaries; fairly, it’s an enormous cost-saving transfer on the a part of the federal government.

Uncover Extra: 3 Little-Recognized Social Safety Guidelines That May Save You 1000’s

Test Out: I am a Retired Boomer: 6 Payments I Canceled This Yr That Have been a Waste of Cash

Whatever the reasoning behind it, you’ll want to arrange for it. Right here’s what you’ll must know concerning the historic shift.

Though a seismic shift when it comes to transitioning from outdated methods to new, only a few beneficiaries will truly be affected by the change to digital funds.

In response to the SSA, lower than 1% of beneficiaries at the moment obtain paper checks, which is a staggeringly small share. Nonetheless, with practically 74 million Individuals receiving advantages, that also quantities to nearly three-quarters of 1,000,000 recipients.

To make a easy transition and guarantee they don’t miss out on any funds, these beneficiaries must change to one in all two digital fee strategies, per the SSA:

-

Enroll in direct deposit: That is most likely the simplest and commonest methodology. Very like you’d get a direct deposit out of your employer into your checking account, you may join direct deposit of your Social Safety advantages.

-

Get a Direct Specific® Card: When you don’t have or need a checking account for no matter motive, you may obtain your advantages by way of a Direct Specific® card. This can be a pay as you go debit card that the SSA reloads each month. Like some other pay as you go card, you should utilize it to make purchases or pay payments. You can too get money from an ATM machine utilizing the cardboard.

Learn Subsequent: Social Safety Full Retirement Age Went Up This Month — Why It Might Proceed To Rise

Change might be uncomfortable for a lot of, significantly in terms of dealing with cash. The SSA understands this and presents these useful solutions to questions beneficiaries might have concerning the change:

Though the web might be useful, if you happen to’re uncomfortable with it, you may nonetheless get your funds. Because the SSA factors out, digital deposits don’t require web use. When you go the direct deposit route, you may go to your native financial institution teller to get your cash with out utilizing the web. With the Direct Specific® card, you may merely use it like a debit or ATM card, no web crucial.