Housing market evolution and bold new mega-projects all featured prominently, alongside daring strikes in finance, transport and regional connectivity. Saudi Arabia, Qatar and Abu Dhabi additionally made headlines with initiatives set to reshape progress, mobility and funding flows.

Meet up with 10 of the most important tales this week as chosen by Arabian Enterprise editors.

Dubai colleges: All 23 ‘Excellent’ KHDA colleges revealed

Dubai has confirmed 23 personal colleges as “Excellent” for the 2023-2024 inspection cycle, the very best score awarded by the Information and Human Growth Authority (KHDA).

The outcomes replicate robust efficiency throughout high quality of instructing, management, scholar wellbeing and total instructional outcomes, providing dad and mom a transparent benchmark of the emirate’s prime establishments.

Charges throughout Dubai’s personal colleges differ considerably relying on curriculum, amenities and yr group, with annual tuition at Excellent colleges usually starting from the low AED30,000s for early grades to greater than AED110,000 for senior yr ranges.

4 new UAE go to visas in 2025 – All you must know

The UAE has issued a big replace to its entry allow system, introducing 4 new go to visa classes designed to draw international expertise, assist key financial sectors and strengthen the nation’s place as a hub for innovation, leisure and tourism.

The adjustments type a part of a broader package deal of amendments introduced by the Federal Authority for Identification, Citizenship, Customs and Port Safety (ICP), which additionally consists of new provisions for humanitarian residence, widows and divorcees, enterprise exploration visas and expanded household sponsorship choices.

Officers say the brand new go to visa classes purpose to streamline entry processes for particular forms of guests whereas supporting fast-growing nationwide priorities corresponding to synthetic intelligence, occasions and marine tourism.

UAE actual property market set to skyrocket to AED486bn by 2030

The UAE’s actual property sector is on monitor to surge to AED486.2 billion by 2030, cementing its position as one of many nation’s strongest financial engines, in accordance with new projections from market evaluation agency Analysis and Markets.

The sector, valued at AED302.65 billion in 2024, is anticipated to develop at a compound annual fee of 8.06 per cent as investor demand, government-backed growth and speedy digital transformation push the market into its subsequent section of growth.

Pushed by regular inhabitants progress, rising worldwide investor curiosity and main infrastructure spending, the UAE continues to place actual property as a cornerstone of its diversified financial system. Analysis and Markets notes that know-how is now a decisive issue on this speedy evolution, with synthetic intelligence, blockchain, digital actuality and augmented actuality turning into central to how properties are designed, marketed and offered.

Emaar unveils Dubai Sq., the world’s first drive-through mall

After giving Dubai a number of iconic actual property initiatives just like the world’s tallest constructing Burj Khalifa, and the sprawling Dubai Mall, Emaar Properties has now unveiled Dubai Sq. – a futuristic retail and leisure vacation spot that will even function the world’s first drive-through mall design.

The venture will anchor Emaar’s Dubai Creek Harbour growth and can span 2.6 million sq. meters of retail, hospitality and business space. Dubai Creek Harbour is a gigantic 11 million sq. meters waterfront growth with a complete growth price of AED180 billion (US$49 billion). That will make it 3 times the dimensions of Downtown Dubai.

The venture underscores Emaar’s imaginative and prescient for the long run, combining residential, business, and leisure areas on the banks of the historic Dubai Creek.

UAE points main adjustments to Business Firms Regulation

The UAE has launched sweeping adjustments to its Business Firms Regulation to permit new share buildings, private-market fundraising and simpler relocation of companies throughout emirates and free zones underneath a federal decree issued this week.

The amendments purpose to modernise the nation’s company authorized framework, broaden investor choices and replace possession and financing buildings as a part of a broader push to strengthen the UAE’s place as a number one international funding vacation spot.

One of the crucial vital adjustments is the introduction of a brand new authorized type, the non-profit firm. Underneath the brand new framework, these entities will reinvest internet earnings into their acknowledged goals somewhat than distribute them to shareholders, making a clearer construction for social and development-focused organisations to function inside a regulated company setting.

Dubai actual property market enters new period of end-user demand and community-led progress

The Dubai residential actual property market entered a brand new section of maturity in 2025, formed by end-user choice making, globally various investor exercise and a transparent shift towards community-led priorities, in accordance with Banke Worldwide Properties’ year-end evaluation.

The corporate mentioned the patterns noticed in 2025 level to sustained demand and evolving purchaser expectations that may affect market behaviour by way of 2026.

Banke reported vital exercise from GCC, Indian, UK and European consumers throughout each off-plan and secondary segments. The primary half of 2025 recorded greater than AED431bn ($117.4bn) in actual property transactions throughout 125,538 offers.

Dubai Islands touted because the ‘new Palm’ as rich consumers snap up trophy waterfront properties – developer

World wealth is more and more focusing on unique beachfront properties as consumers favour island dwelling on Dubai Islands for privateness, solar and proximity to DIFC, a developer advised Arabian Enterprise.

Consumers from Europe, North America and South America are focusing on coastal and island-based properties that mix privateness, direct seashore entry and wellness facilities with longer-term capital progress potential.

The shift is being bolstered by a rising pipeline of residential launches on Dubai Islands, a masterplanned waterfront vacation spot that builders examine to the early rise of Palm Jumeirah.

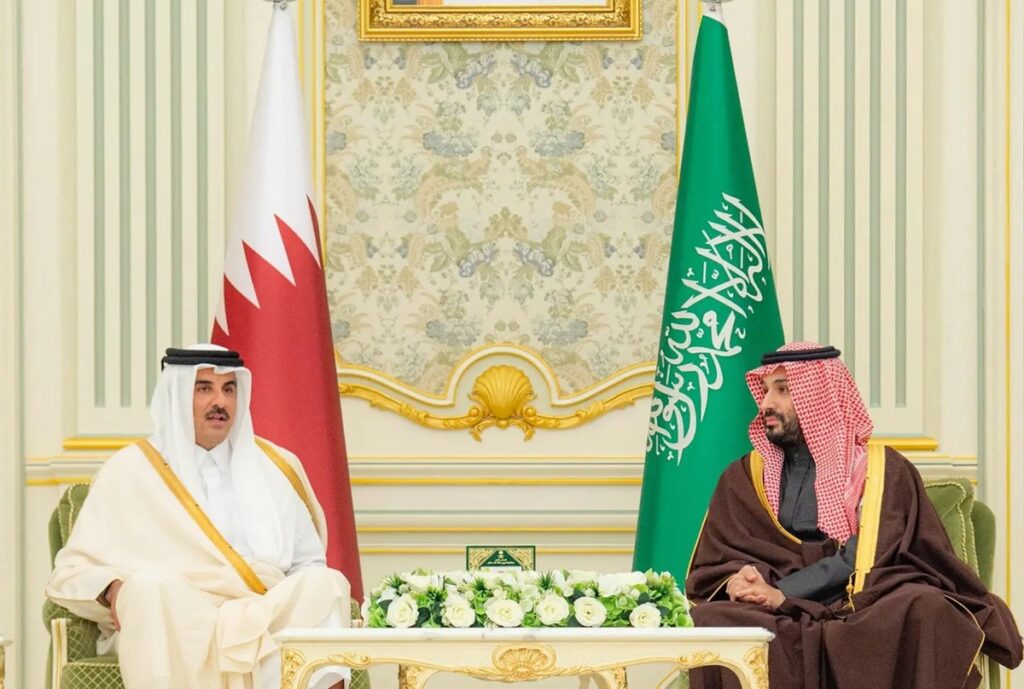

Saudi Arabia and Qatar signal 300kmph, 785km rail hyperlink with $31bn financial influence and 30,000 jobs

Saudi Arabia and Qatar have signed an settlement to implement a 785km high-speed electrical passenger railway connecting Riyadh and Doha.

The foremost growth strengthens regional connectivity and displays the deep-rooted fraternal relations between the 2 international locations.

The railway will hyperlink the 2 capitals and cross by way of Hofuf and Dammam, connecting King Salman Worldwide Airport in Riyadh and Hamad Worldwide Airport in Doha. Designed for speeds exceeding 300kmph, the route will cut back journey time between Riyadh and Doha to roughly two hours, considerably enhancing mobility, supporting commerce and tourism, and enhancing high quality of life.

Abu Dhabi launches main finance cluster to drive $15.25bn GDP enhance, lure $4.6bn funding and create 8,000 new expert jobs by 2045

Abu Dhabi has launched a significant new monetary cluster designed to speed up the emirate’s management in fintech, insurance coverage, digital property and various investments, following approval from Sheikh Khaled bin Mohamed bin Zayed Al Nahyan, Crown Prince of Abu Dhabi and Chairman of the Abu Dhabi Govt Council.

The Abu Dhabi Division of Financial Growth and the Abu Dhabi Funding Workplace introduced the FinTech, Insurance coverage, Digital and Various Property (FIDA) cluster at Abu Dhabi Finance Week 2025.

Spearheaded by the Abu Dhabi Division of Financial Growth (ADDED) and the Abu Dhabi Funding Workplace (ADIO), the cluster goals to strengthen the emirate’s place as a world centre for superior finance and funding.

By 2045, FIDA is projected to contribute a further AED56bn ($15.25bn) to Abu Dhabi’s gross home product, create 8,000 new expert jobs and appeal to not less than AED17bn ($4.63bn) in funding, supporting the UAE’s wider financial diversification agenda.

UAE publicizes 2026 vacation

The UAE has introduced a vacation for public sector to have fun the 2026 New Yr.

In an official assertion the Federal Authority for Authorities Human Assets mentioned that January 1, 2026 might be a public vacation for all federal authorities staff.

It represents the primary official vacation of subsequent yr and can fall on a Thursday.