It is time to spotlight the iShares 0-3 Month Treasury Bond ETF (NYSEARCA:SGOV).

I am going to sum it up briefly:

- Easy ETF. It does not get a lot simpler than this.

- The investments are short-term Treasuries.

- Period is minimal.

- Credit score high quality is outstanding as a result of it is Treasuries.

- Volatility is about as near none as we are able to get whereas nonetheless having ex-dividend dates. Practically all the transfer within the share value is simply accruing dividends and paying them out.

- Since ETFs centered on Treasury payments aren’t notably distinctive, the expense ratio is essential. The expense ratio is 0.09%, which is excellent for one of these ETF. Whereas I at all times need to see expense ratios go decrease, this is without doubt one of the greatest for what it does.

- If you understand of any that do the identical factor as SGOV however with an expense ratio underneath 0.05%, let me hear about it within the feedback.

You are still right here studying? Alright, I am going to attempt to put some extra phrases on this article. Perhaps even a picture or two.

The Dividend

One of many major causes for utilizing SGOV is that you really want the dividends. You are coping with Treasuries. Treasuries are higher for taxes than coping with company bonds. At the very least for many Individuals.

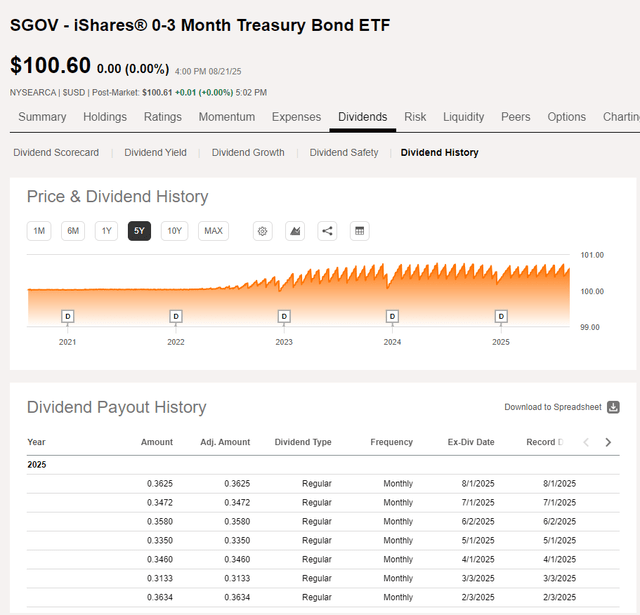

So let’s check out the dividends:

In search of Alpha

Not unhealthy. You may see instantly that the dividend began to dip. That is as a result of the short-term charges have been lowered.

Decrease short-term charges imply a decrease price when it buys new Treasury payments.

Worth Stability

I feel this subsequent chart actually helps to clarify it:

In search of Alpha

Ignore that the chart solely exhibits the dividend as soon as per 12 months on the value part. It is really paid out month-to-month, as you’ll be able to see within the desk a part of the picture. These dividends are the rationale that the value goes up and down.

It skips a January payout, and it pays out twice in December. That is why the sample appears slightly funky.

Why was it so clean earlier than 2022? As a result of short-term charges have been principally nothing. When the dividend is principally nothing, there is no cause for it to maneuver up and down with the dividend accrual and ex-dividend date.

I exploit three ETFs for my money:

- SGOV

- iShares Brief Treasury Bond ETF (SHV)

- SPDR Bloomberg 1-3 Month T-Invoice ETF (BIL)

Are these the right selections? Maybe not. However it’s shut sufficient to work fairly nicely. I am positive there generally is a nice dialogue within the feedback about which of them are the perfect.

Many traders could not understand how a lot they’re throwing away by holding their money in a checking account. Perhaps you went round looking for the financial institution that might give you a greater price in your money. That is high-quality if you happen to did.

It isn’t one thing I need to spend my time on. As a substitute, I hold minimal money in my checking account and a bunch of money in short-term Treasury ETFs.

On condition that I can often hold my checking account stability under $10k (different than simply earlier than I ship in my prepayments for taxes), it is not price fussing about which financial institution will give me a greater price on checking. I can simply hold my extra in Treasury invoice ETFs.

OK, what I am saying is I have been too busy to cease utilizing USAA. They have been excellent about 20 years in the past. Perhaps even 15 years in the past. Now only a dim shadow of their former glory.

How Do You Use SGOV?

At first, cease considering that that is an funding. It isn’t an funding. SGOV is a money different. It is extraordinarily liquid. The value is extraordinarily steady. It pays a lovely yield.

Sure, you’ll be able to maintain SGOV in your portfolio. I do. However I simply label it as “money.” I label all of my Treasury Invoice ETFs as “money.” For me, there is not a lot distinction.

If in case you have an enormous shock invoice, what do you do?

You set it in your bank card!

No, that wasn’t being sarcastic. You set it in your bank card to get your money again rewards (or miles if that is the way you roll) and you then pay that card off in full earlier than you incur a dime of curiosity. In the event you’re paying curiosity on bank cards, I do not even know what you are doing studying about these ETFs.

In the event you’re paying bank card curiosity, you do not want my article. You want Dave Ramsey yelling to eat cat meals till you’ve financial savings or one thing like that. That is his factor, proper? Cat meals? No? Look, I do not hearken to his present. If he yelled about consuming cat meals, then I in all probability would watch it.

New thought for a YouTube channel? You make YouTube movies the place you are taking calls and yell about consuming cat meals. I’ll completely give your channel a shot.

Life Lesson: Do not pay 30% in non-deductible credit-card curiosity simply to earn 4% in taxable curiosity.

3 Forms of Idle Money

I’ve three forms of idle money.

- Idle money that I might have for private bills.

- Idle money in my enterprise account as a result of I am not insane.

- Idle money in my portfolio between investments.

Which sort ought to I put money into short-term Treasury invoice ETFs?

All three of them.

If I’d want the money in underneath a month, then it will possibly sit in checking and earn peasant rates of interest. In any other case, I am going to take the Treasury Invoice ETFs.

Critically, if you happen to’re sitting on $30k in checking (not even sufficient to be a correct security fund), you are lacking out on over $1k in curiosity per 12 months. At the very least in case your checking account rates of interest are as little as those I am getting from USAA.