We don’t normally see the mREITs dramatically outperforming the BDC sector. However it positive occurred this 12 months.

There are at the very least two components in play:

- Brief-term charges are falling.

- Bankruptcies by just a few debtors are making buyers skittish about different unrelated loans.

We’re going to deal with the current relative power within the mortgage REITs this time, as we talked about BDCs final time:

We are able to use the $100,000 chart to match the current efficiency for some sector-based ETFs:

The REIT Discussion board

As a result of this chart is constructed across the values right this moment, it does a significantly better job of demonstrating how prior investments would’ve carried out primarily based on any potential date vary. Who desires a chart that anchors every thing to an arbitrary start line? In our chart the ending level may be arbitrary, however “right this moment” is normally essentially the most helpful arbitrary date you will get. Sorry, I can’t offer you two years sooner or later. Nonetheless, our charts do an excellent job of adjusting for the dividends. As a result of whenever you’re investing in shares with big yields, you really want to issue that into the calculations. Big yields usually are not free. They arrive with dangers, and they’re a serious a part of the return image.

The Mortgage REIT ETF

We’re utilizing the VanEck Mortgage REIT Revenue ETF (NYSEARCA:MORT) to characterize mortgage REITs and utilizing the VanEck BDC Revenue ETF (BIZD) and Putnam BDC Revenue ETF (PBDC) to characterize the BDCs. Within the chart above, it is clear that MORT outperformed ranging from any level within the final 12 months. In some circumstances, the outperformance was substantial.

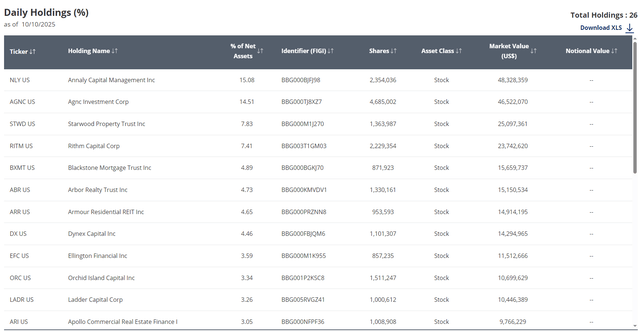

So what’s occurring? Properly, first we should always have a fast take a look at the holdings:

VanEck

The highest two positions are in mortgage REITs centered on company mortgage-backed securities. Company mortgage REITs are notably delicate to rates of interest. Nonetheless, many individuals misunderstand the publicity.

The Misperception

Many individuals assume that mortgage REITs, and particularly company mortgage REITs, merely profit from decrease rates of interest. Nonetheless, that is not the case. If mortgage charges decline dramatically, that has a destructive affect on mortgage REITs as a result of it results in a surge in prepayments on mortgages that had greater coupon charges. That may be unhealthy for the mortgage REITs.

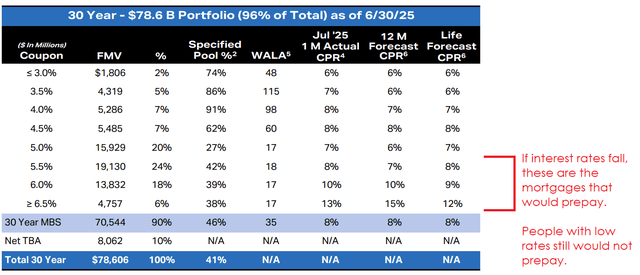

Right here’s an instance utilizing the holdings from AGNC’s portfolio:

AGNC

There are three main methods somebody could prepay their mortgage:

- They pay it off by refinancing.

- They pay it off as a result of they’re promoting the home.

- They pay it off by paying additional principal together with their cost.

What sort of prepayment surges when charges fall? It’s the primary choice. Folks with higher-rate mortgages refinance into lower-rate mortgages.

My condolences to everybody who didn’t have an opportunity to purchase a house within the final 17 years. There have been some fairly good alternatives. I might pay additional on my mortgage, however I received’t. It’s locked in at 2.125%. Why would I pay additional for that? I simply choose up short-term Treasuries (okay, a Treasury Invoice ETF). I nonetheless get the flexibleness of getting money, and I get greater than sufficient curiosity to offset the price of the mortgage.

What if Charges Rise?

At the moment, all the main target is on charges falling. However we should always at the very least deal with the opposite potential situation. Mortgage REITs don’t need charges to extend considerably as a result of:

- The worth of their MBS holdings would decline.

- The price of financing would enhance.

- The prepayments on their MBS would decline an excessive amount of, which might make it take longer to get their a refund to reinvest.

What Mortgage REITs Can Do

If charges reverse and climb greater as a substitute, then mortgage REITs would progressively shift into higher-yielding mortgages, but it surely takes time. They may dump lower-yielding mortgages in that situation, however they might be pressured to simply accept a lot decrease costs. Consequently, they sometimes want to be rather less energetic in managing the portfolio. In brief, the mortgage REIT would favor that rates of interest not enhance or lower dramatically.

What About Fed Funds Charges?

Mortgage REITs do stand to profit from a discount within the Fed Funds Charge. They usually hedge lower than everything of their borrowing prices, and when that occurs, it permits them to profit from decrease short-term charges. Sadly, many buyers appear to assume that mortgage REITs will solely hedge a really small portion of their publicity to funding prices. That may be horribly inaccurate. They sometimes hedge the substantial majority, at the very least for the brief to medium time period. There have been occasions after we’ve seen them hedge greater than 100%.

The perfect situation for mortgage REITs includes mortgage charges remaining comparatively secure with a really gradual decline within the Fed Funds Charge.

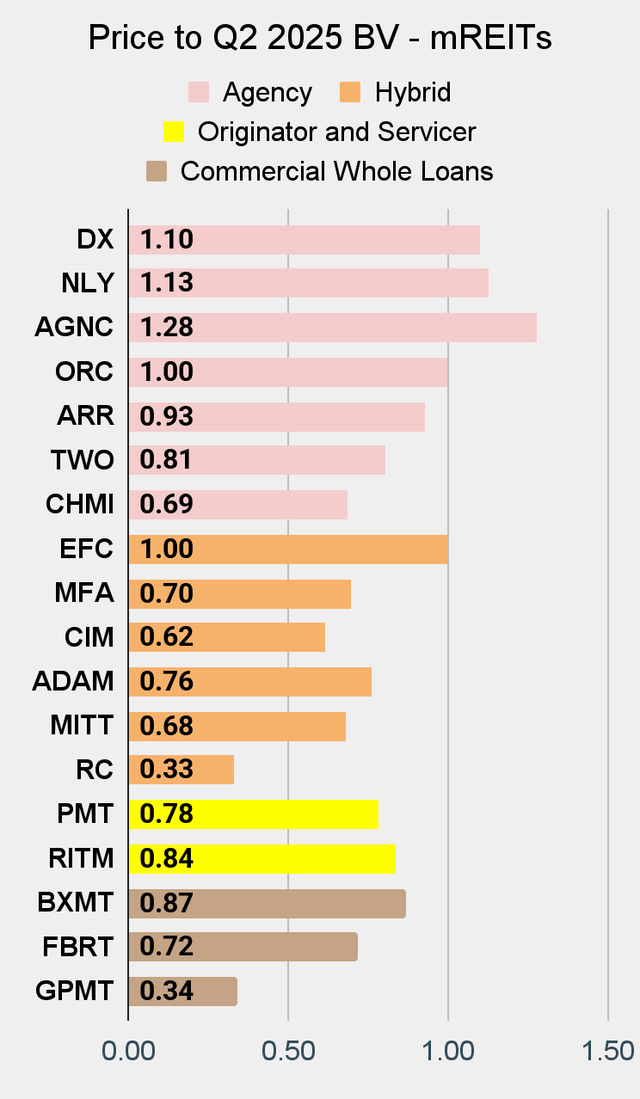

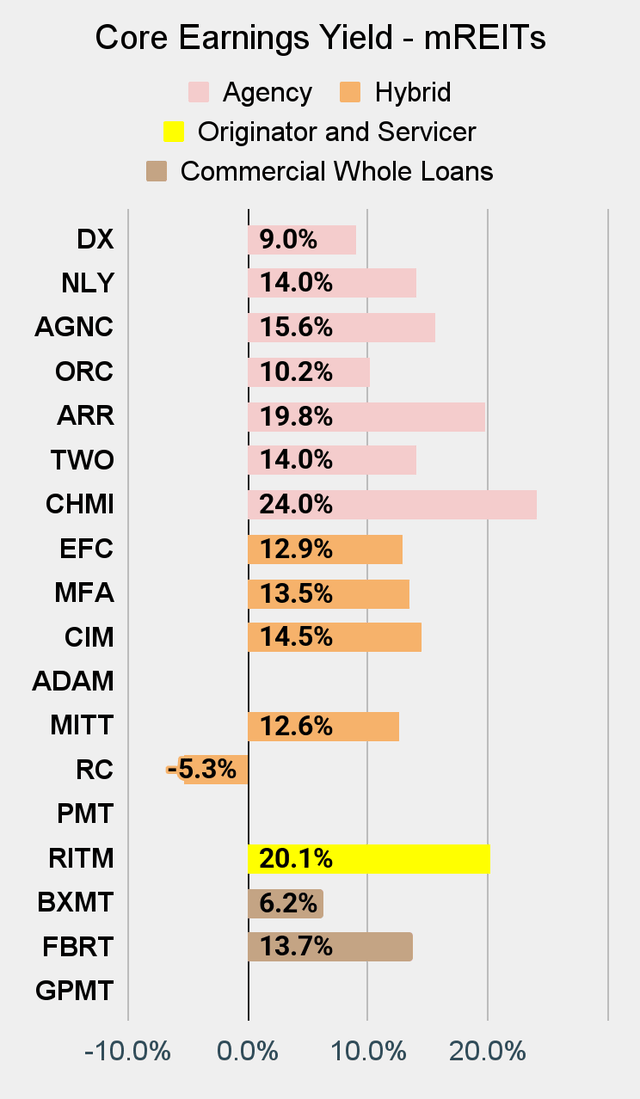

Once we take a look at the most important mortgage REITs, that are additionally the highest two holdings in MORT, we see pretty excessive valuations. Their price-to-book worth utilizing our current estimates is about 1.08x and 1.23x. That’s decrease than the ratio within the chart. By our estimate, e book values for these mortgage REITs have most likely elevated by about 4% to five% between 6/30/2025 and final Friday. Sure, we run our estimates fairly incessantly. The modifications in e book worth we’re projecting all through the sector are materially completely different, although. Whereas Annaly (NLY) and AGNC (AGNC) have been fairly related to one another, among the mortgage REITs are more likely to report declines in e book worth per share for Q3 2025.

Do I Like Mortgage REITs Right here?

There are some alternatives. A number of are costly, however there are a handful which might be getting fairly low-cost. For frequent shares, I’ve been extra energetic within the BDCs than within the mortgage REITs recently. Simply making the most of that huge slide in BDC costs. Nonetheless, I would choose up among the mortgage REIT frequent shares as effectively. It’s not a nasty time, however I might need to choose these entries fastidiously.

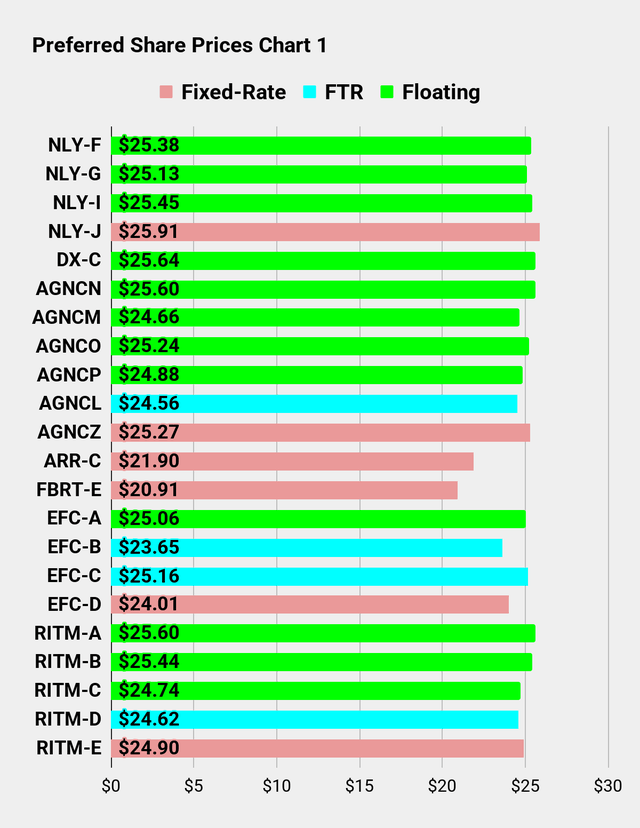

I am sometimes extra involved in discovering alternatives to commerce in most popular shares and child bonds. We nonetheless get a sexy yield, however the costs are a lot steadier. That’s nonetheless my basic theme. I’ll preserve searching for alternatives to allocate to the popular shares and child bonds, however with the current weak spot, I am beginning to tackle a bit extra frequent share publicity once more.

I am going to disclose an additional commerce right here. Whereas AGNC and NLY are the largest company mortgage REITs, we have usually been extra involved in Dynex (DX). Scott Kennedy initiated a place in DX in late September at $11.95 and bought it slightly below per week in the past at $13.05. Easy buying and selling round price-to-book ratios.

Evaluation Technique

We’re consistently engaged on offering new up to date estimates for BV (e book worth) and NAV (web asset worth) in The REIT Discussion board. Nonetheless, many buyers fail to even evaluate the trailing values. On this collection, we calculate the price-to-trailing BV or NAV for a lot of mortgage REITs and BDCs in addition to offering a number of metrics on child bonds and most popular shares. Charts for these issues can be found close to the tip of the article.

We emphasize price-to-BV and price-to-NAV as a result of these metrics present perception into valuations.

All of the Shares

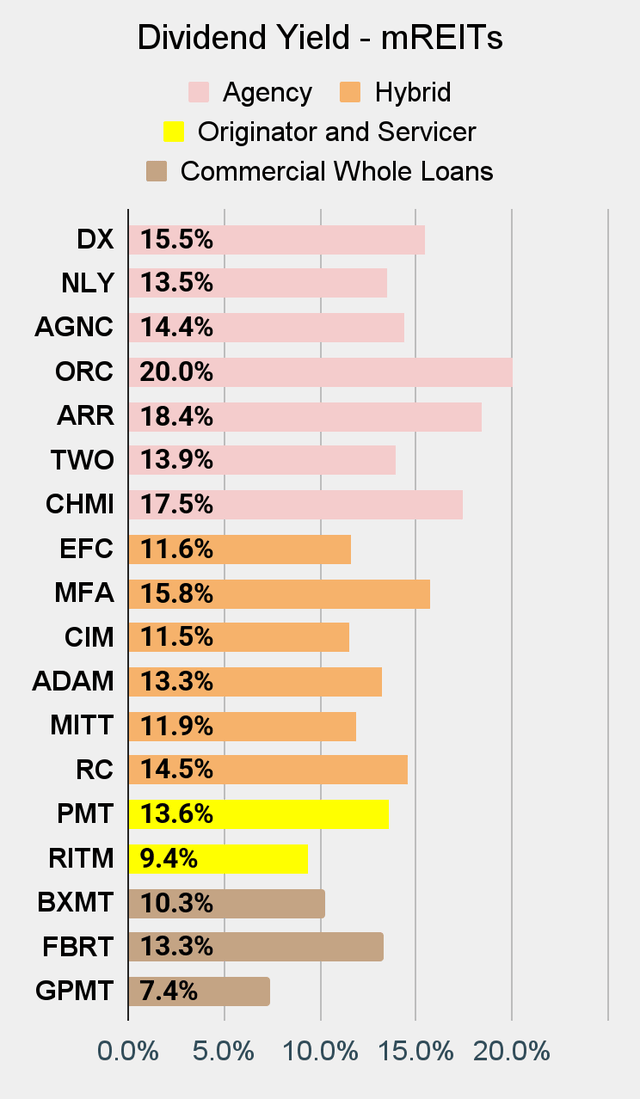

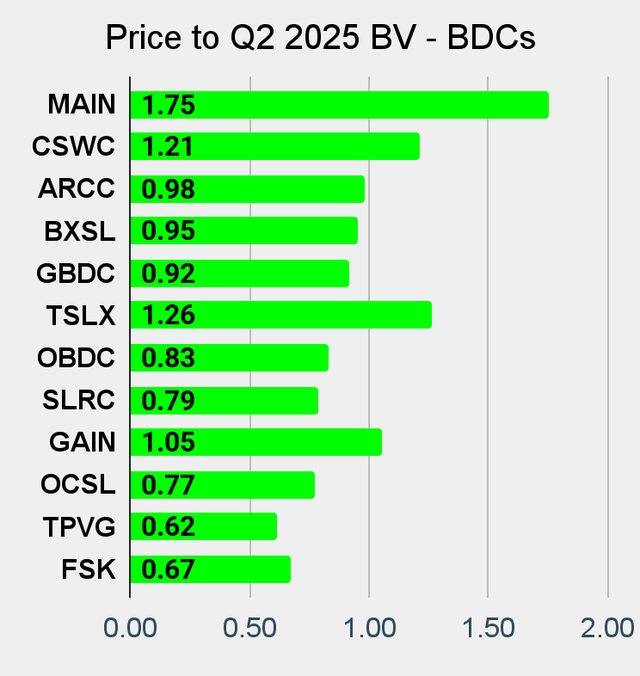

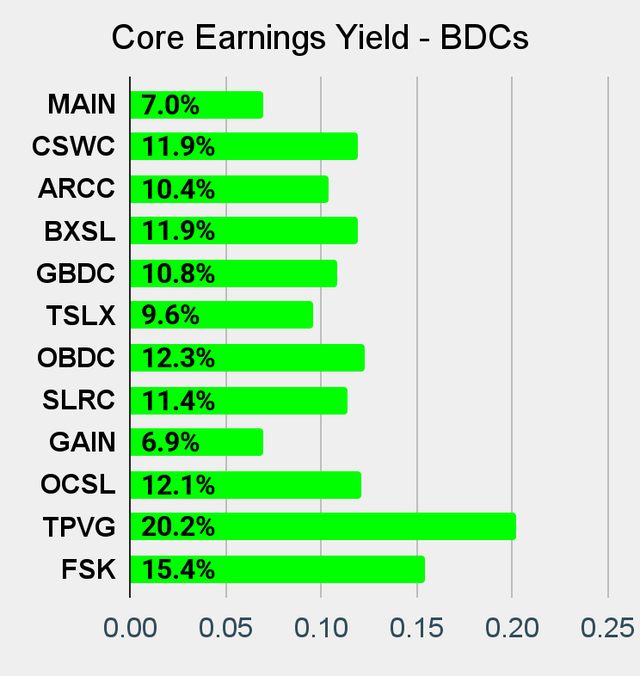

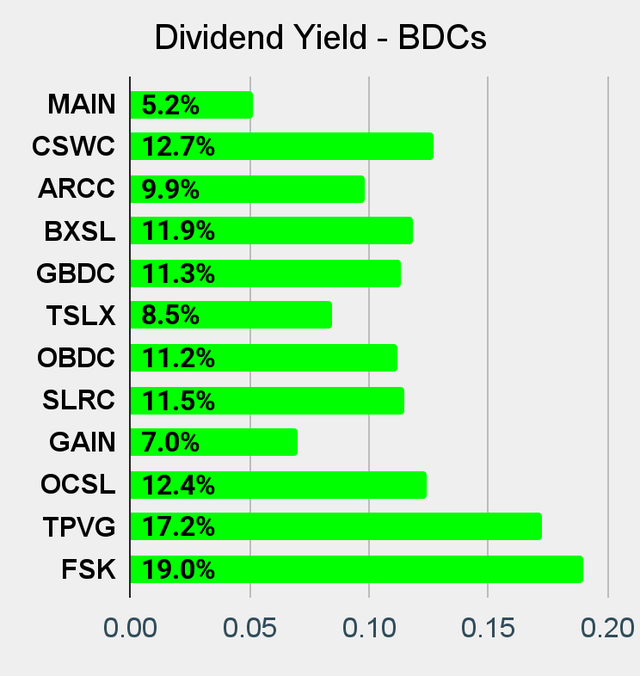

The charts evaluate the next firms and their most popular shares or child bonds:

- BDCs: (CSWC), (BXSL), (TSLX), (OCSL), (GAIN), (TPVG), (FSK), (MAIN), (ARCC), (GBDC), (OBDC), (SLRC)

- Industrial mREITs: (GPMT), (FBRT), (BXMT)

- Residential Hybrid mREITs: (MITT), (CIM), (RC), (MFA), (EFC), (ADAM)

- Residential Company mREITs: (NLY), (AGNC), (CHMI), (DX), (TWO), (ARR), (ORC)

- Residential Originator and Servicer mREITs: (RITM), (PMT)

Notice: NYMT just lately modified their ticker to ADAM. The brand new ticker is included in our charts. The infant bonds and most popular shares additionally modified tickers, with NYMT being changed by ADAM inside every ticker. As an illustration, NYMTZ turned ADAMZ.

Embedded Charts

Mortgage REITs and BDCs:

The REIT Discussion board |

The REIT Discussion board |

The REIT Discussion board |

The REIT Discussion board |

The REIT Discussion board |

The REIT Discussion board |

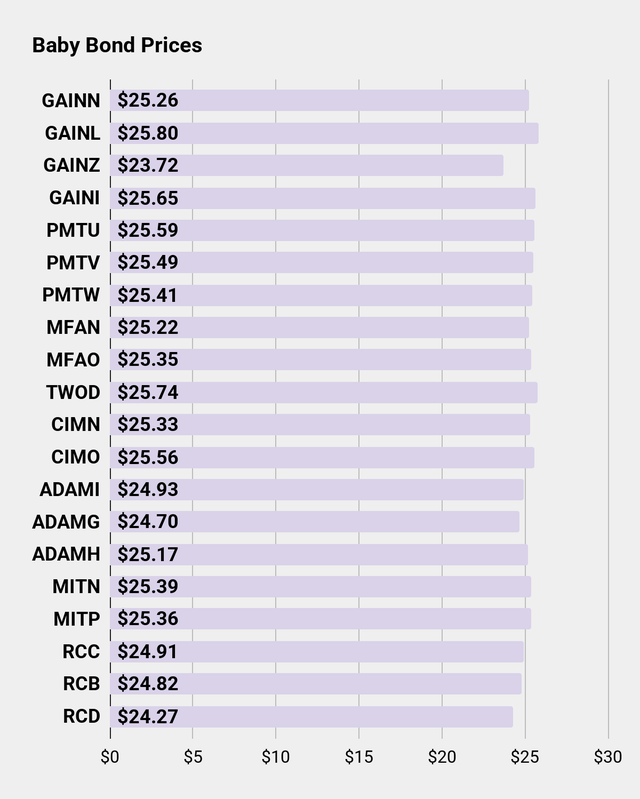

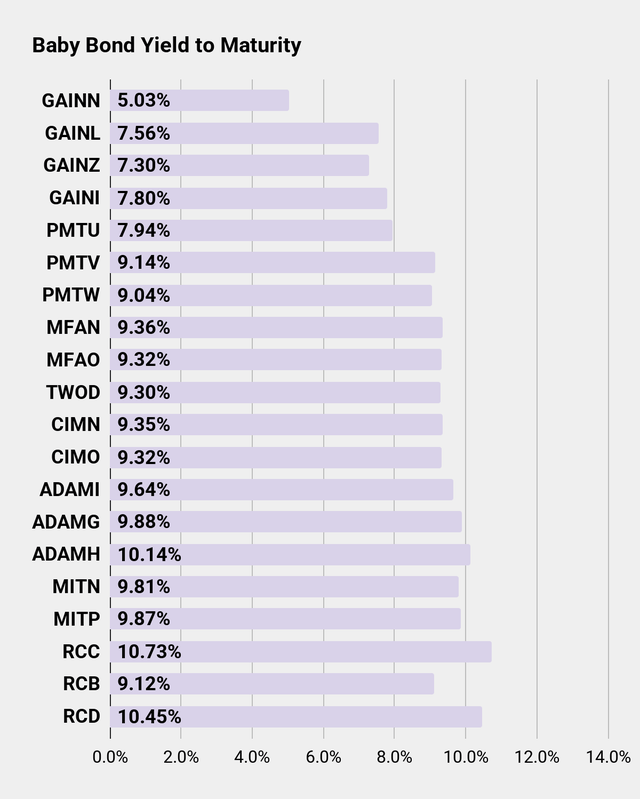

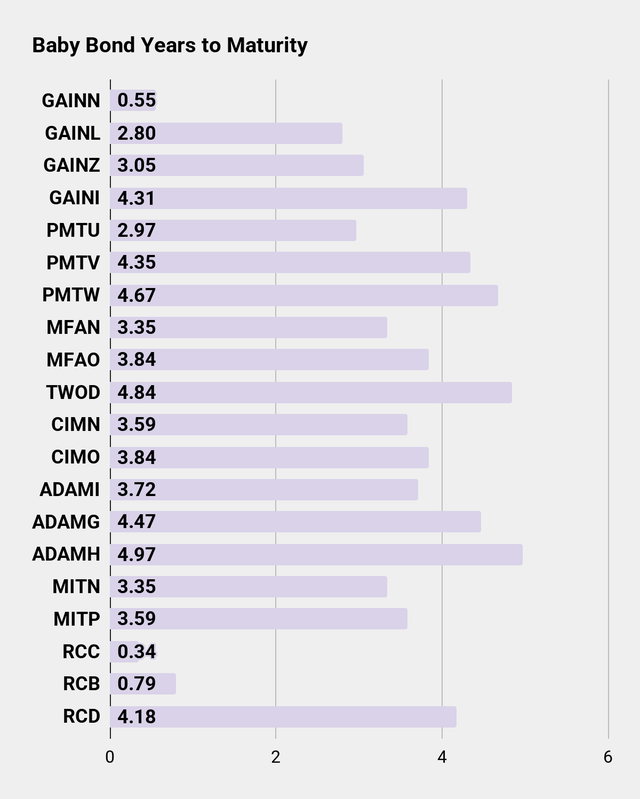

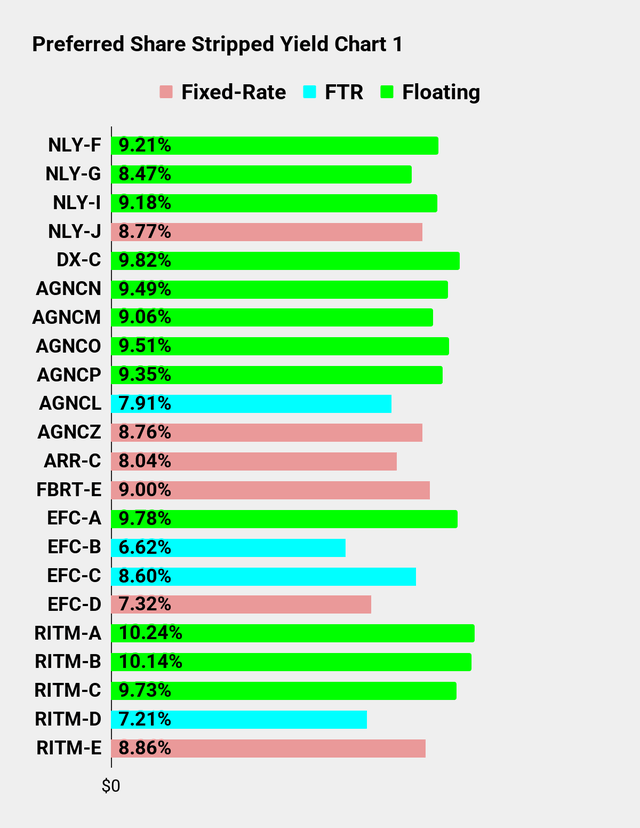

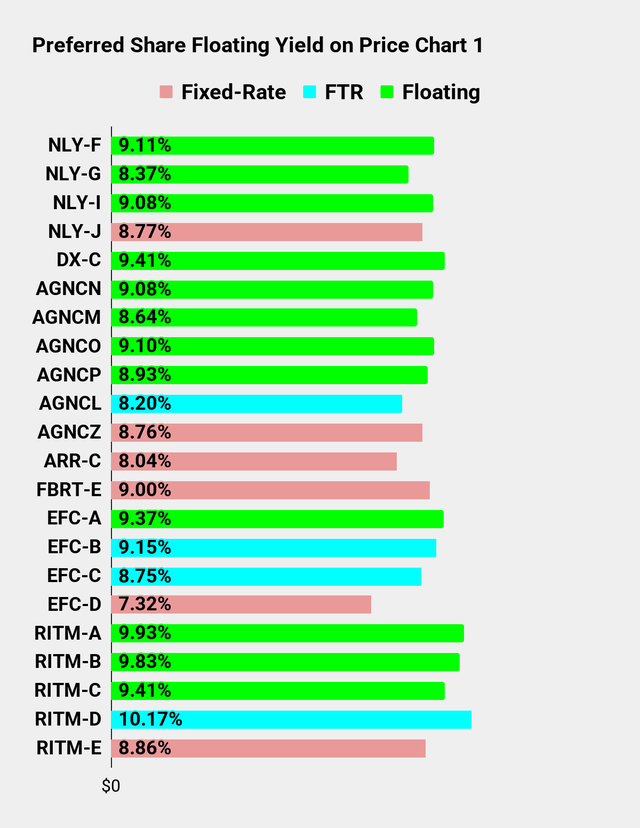

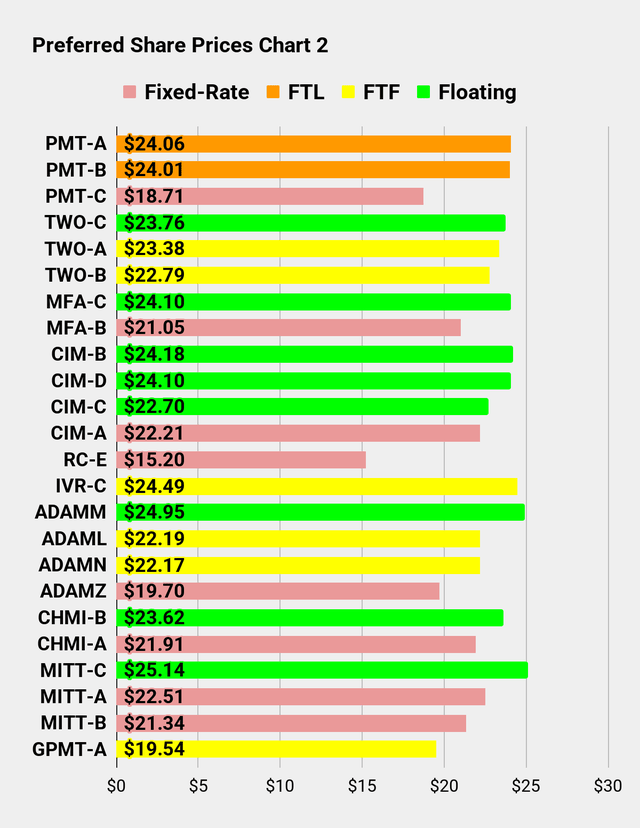

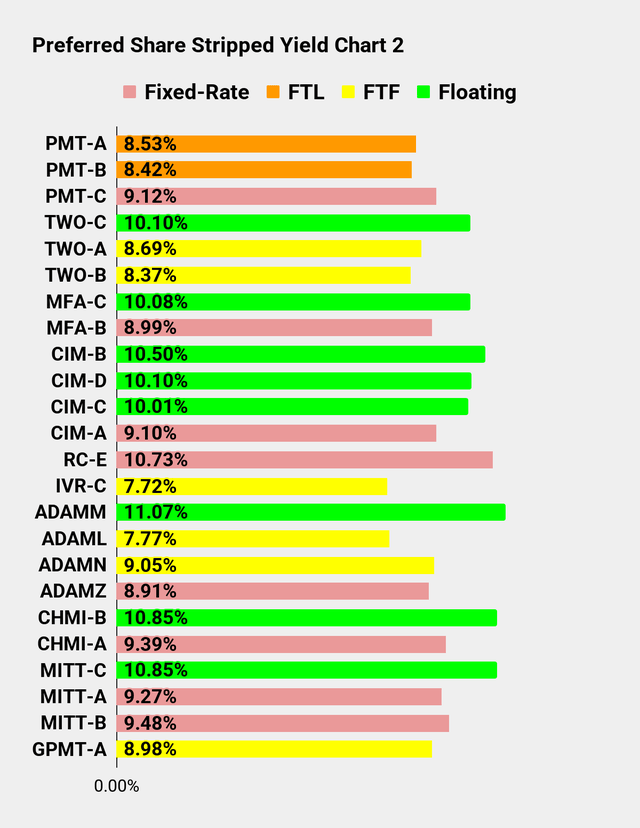

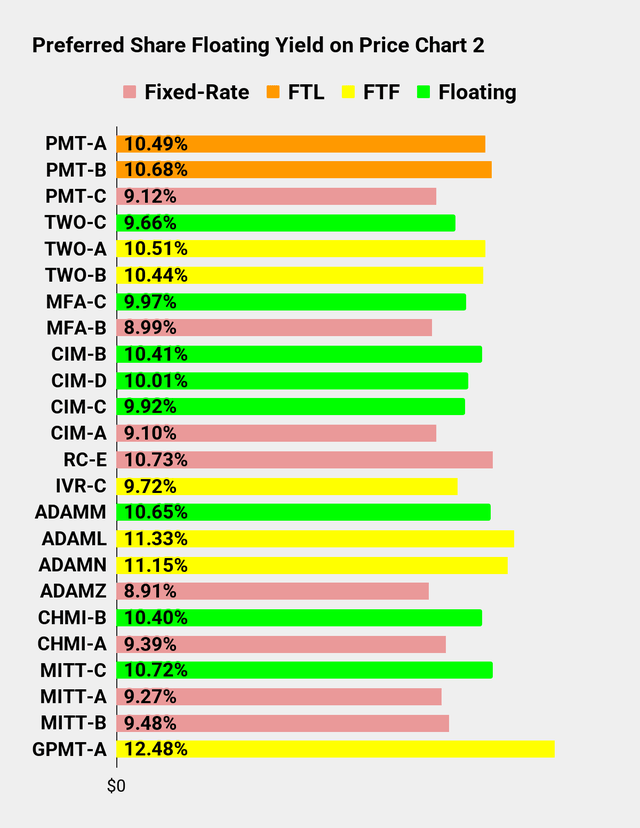

Most well-liked shares and child bonds:

The REIT Discussion board |

The REIT Discussion board |

The REIT Discussion board |

The REIT Discussion board |

The REIT Discussion board |

The REIT Discussion board |

The REIT Discussion board |

The REIT Discussion board |

The REIT Discussion board |

Thanks for studying, and I hope you loved the charts.

Some terminology:

- FTF = Fastened-to-floating. Share is at present fastened however will start floating primarily based on SOFR. We could reference LIBOR, however that is assumed to be SOFR + 0.26161%.

- FTR = Fastened-to-reset. Share is at present fastened. It is going to ultimately start resetting each 5 years primarily based on the 5-year Treasury charge.

- FTL = Fastened-to-lawsuit. The corporate determined that their FTF shares might be “fixed-to-fixed” regardless of clearly violating the unique intent of the contract.

- Floating = A share that was FTF however is now floating. The dividend charge is up to date each three months.

Thank You

Editor’s Notice: This text covers a number of microcap shares. Please pay attention to the dangers related to these shares.