-

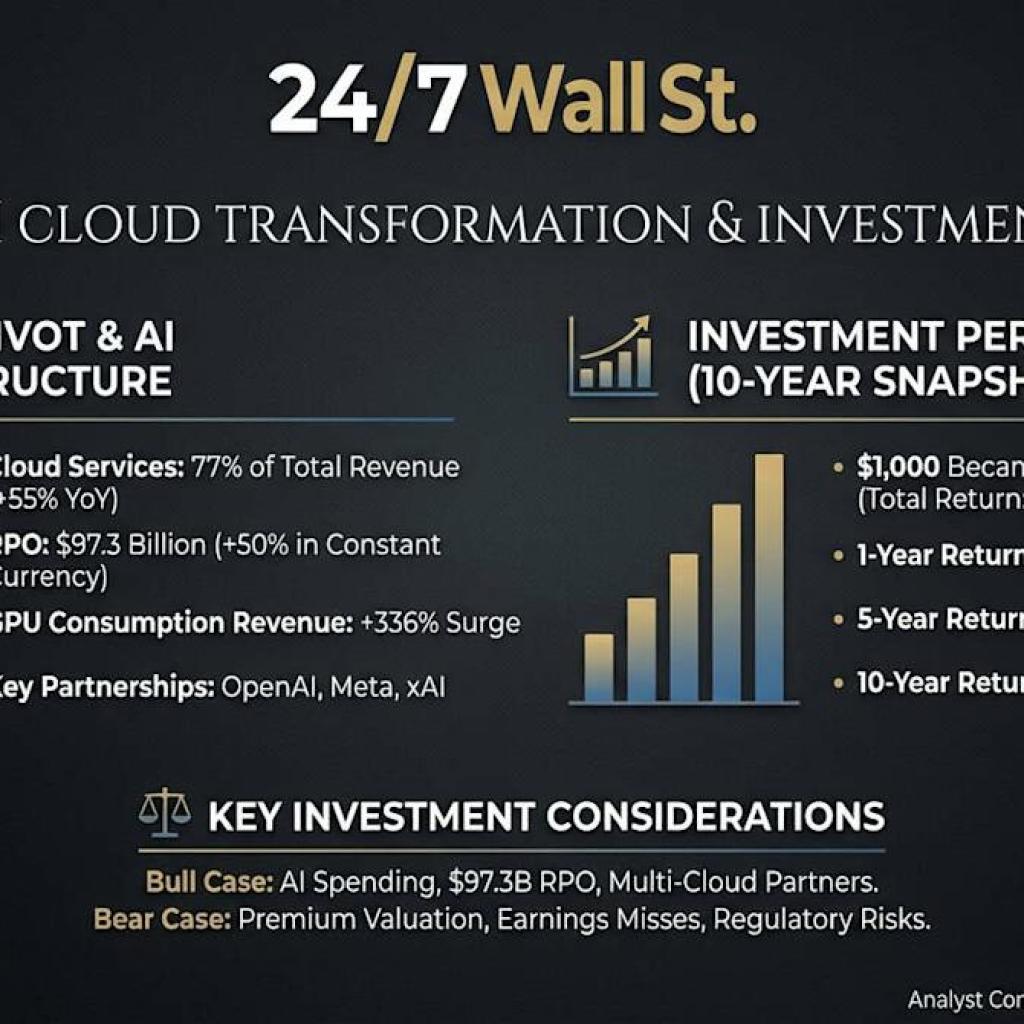

Oracle (ORCL) cloud companies now characterize 77% of complete income and grew 55% year-over-year. GPU consumption income surged 336%.

-

Oracle’s remaining efficiency obligation hit $97.3B in Q2 FY2025. Cloud RPO grew practically 80% and represents three-fourths of complete RPO.

-

The inventory dropped 46% from $345.72 in September 2025 to $185.63 two months later regardless of sturdy fundamentals.

-

In case you’re eager about retiring or know somebody who’s, there are three fast questions inflicting many People to appreciate they will retire sooner than anticipated. take 5 minutes to be taught extra right here

Oracle Company (NYSE: ORCL) spent twenty years as a database big earlier than pivoting onerous into cloud infrastructure. That shift accelerated dramatically after 2020, when hyperscale AI workloads grew to become the corporate’s defining progress engine. Oracle constructed modular information facilities, signed partnerships with OpenAI and Meta, and positioned itself because the quickest, most cost-effective possibility for coaching giant language fashions. The technique labored. Cloud companies now characterize 77% of complete income and grew 55% year-over-year in the newest quarter.

The corporate’s remaining efficiency obligation hit $97.3 billion in Q2 FY2025, up 50% in fixed forex. CEO Safra Catz famous that “our cloud RPO grew practically 80% and now represents practically three-fourths of complete RPO.” Oracle’s GPU consumption income surged 336% as demand from AI clients outstripped provide. Chairman Larry Ellison emphasised the corporate’s technical edge: “We simply prolonged our AI efficiency benefit by delivering the most important and quickest AI supercomputer on the earth, scaling as much as 65,000 Nvidia H200 GPUs.”

The inventory mirrored this transformation. Oracle went from a gentle, dividend-paying worth play to a risky AI commerce with excessive worth swings in 2025.

1-Yr Return

-

Preliminary Funding: $1,000

-

Present Worth: $1,319

-

Whole Return: 31.9%

-

S&P 500 (identical interval): Roughly 26%

5-Yr Return

Oracle’s strategic shift to AI infrastructure is highlighted, detailing spectacular cloud income progress, sturdy historic funding efficiency in opposition to the S&P 500, and key components influencing its future outlook.

-

Preliminary Funding: $1,000

-

Present Worth: $3,817

-

Whole Return: 281.7%

-

Annualized Return: 30.7%

-

S&P 500 (identical interval): Roughly 15% annualized

10-Yr Return

-

Preliminary Funding: $1,000

-

Present Worth: $5,726

-

Whole Return: 472.6%

-

Annualized Return: 19.0%

-

S&P 500 (identical interval): Roughly 13% annualized

Oracle crushed the S&P 500 at each time horizon, however the experience required conviction. The inventory hit $345.72 in September 2025 earlier than collapsing to $185.63 two months later, a 46% drawdown. Timing mattered enormously. Buyers who purchased on the peak are down 37% regardless of sturdy fundamentals.