Ralf Hahn/iStock by way of Getty Pictures

By Jim Iuorio

Silver’s efficiency over the previous 12 months has been nothing wanting spectacular. Between early September and early November 2025, the metallic vaulted to a rally of virtually 50%, a surge that eclipsed the positive aspects of nearly each different asset. This meteoric rise was powered by a multi-layered confluence of market circumstances. From its deep-rooted correlation with gold to a supply-demand imbalance pushed by the worldwide crucial for electrification, AI and crypto mining, a number of forces kicked in concurrently. Understanding this exact second of convergence requires a deeper look into each positioning and underlying market psychology.

The Gold-Silver Relationship

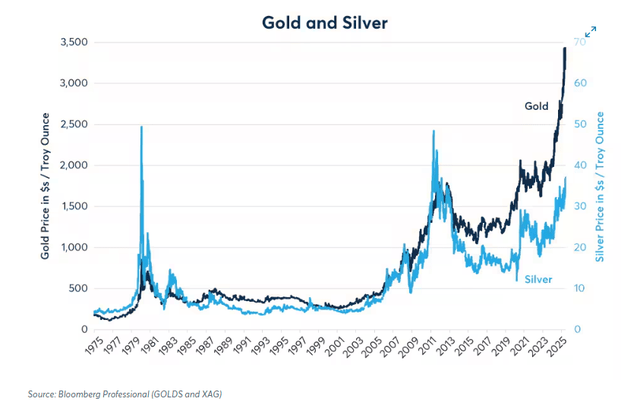

First, let’s have a look at silver’s relationship to gold. The gold-to-silver ratio during the last 50 years has averaged roughly 67. Which means, on common, it will take 67 ounces of silver to purchase one ounce of gold. That common during the last six years has shot as much as virtually 84. The explanations for this appear fairly easy: the financial panic associated to the Covid-19 pandemic brought on a rush into what is usually seen because the world’s most secure asset, gold. However even because the financial stress subsided, one other compelling tailwind for gold emerged.

World central banks accelerated their stockpiling of the metallic as a substitute for holding reserves strictly in U.S. {dollars} and treasuries. For some perspective on that, in 2017, 64% of the world’s reserves had been held in {dollars}. That quantity has dwindled to roughly 57%. This shift appeared to speed up in relation to what some nations seen as a heavy-handed strategy in how the U.S. handled Russia within the wake of its invasion of Ukraine. The U.S. orchestrated a freezing of Russian dollar-denominated property and blocked Russia from taking part within the international SWIFT fee system.

Many will make the affordable argument that these actions had been vital, however that actually doesn’t imply there can’t be second-derivative ramifications. As economist Thomas Sowell stated, “There are not any options, solely tradeoffs.” On this occasion, the tradeoff was a worldwide try at de-dollarization. Aspect be aware: the phrase “try” was rigorously chosen and underscores a pervasive perception that there isn’t any legit different to the security and stability of {dollars} and that these makes an attempt might finally fail. It’s additionally price mentioning that the commerce insurance policies in all probability gave extra motivation for nations to hunt a substitute.

The web end result was an enormous rally in gold that pushed the gold-silver ratio as much as a four-year excessive of 104 in Could of 2025. This marked the second-highest ratio in recorded historical past, the best being the 120 studying within the fast aftermath of the 2020 pandemic. An extra tailwind to gold’s rally was a rising perception that the present explosive ranges of U.S. deficit spending might have a major unfavourable influence on the worth of the U.S. greenback. This “debasement commerce” has been a tailwind to all arduous property, however gold was the most important beneficiary due to the extra geopolitical elements.

The Electrification Narrative

It’s been a noticeable attribute of the gold-to-silver relationship, traditionally, that in instances of stress, the market’s knee-jerk response is to hurry into gold. Later, because the mud settles, silver typically has aggressive catch-up strikes. Silver’s efficiency in late 2025 was no exception. Though gold’s magnetic pull on silver set the ball in movement, the silver commerce additionally had its personal accelerant that fueled the meteoric rise.

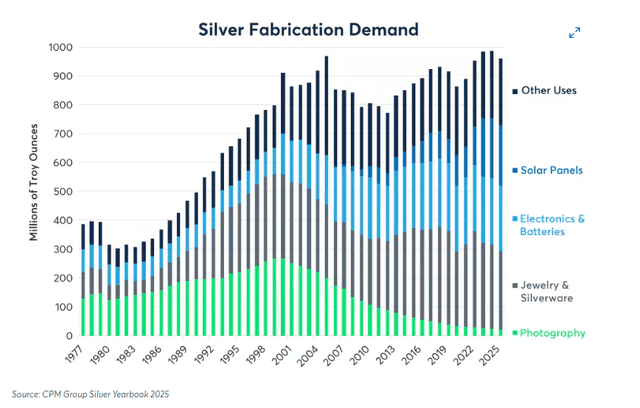

It’s typically the case that an asset will start a transfer that’s initially primarily based on technical elements. As soon as that transfer is established, the basic narrative emerges and gives gas for subsequent legs greater. In silver, the narrative entails structural deficits in opposition to ever-increasing demand for electrification.

During the last two years, the prospect of evolving AI know-how has been a dominant driver of fairness market returns. What’s solely lately been talked about is the huge quantities of power that will likely be wanted to energy the information facilities required to help the brand new know-how. This narrative has been a further tailwind for the economic metals house and has supported large positive aspects. Copper rose 40% in 2025, whereas platinum jumped over 130% and palladium was up over 75%. Silver far outpaced them everywhere in the similar interval, with positive aspects of virtually 155%.

The Good Storm

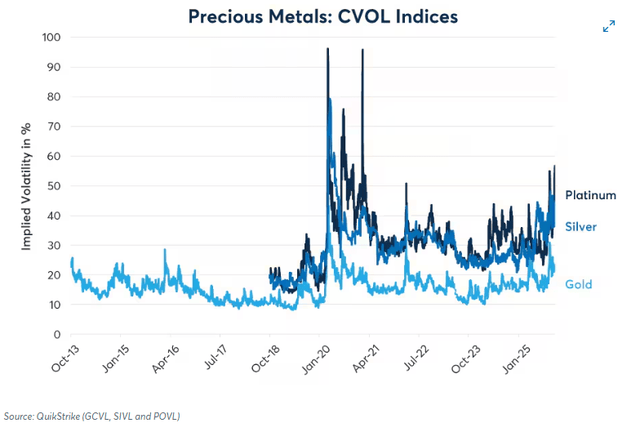

Silver’s extraordinary efficiency isn’t nearly one issue – it’s about timing. The setup from an excessive gold-silver ratio offered the springboard. The basic story of structural provide deficits and surging industrial demand offered the gas. And the broader market psychology round de-dollarization and arduous property offered the conviction. When a number of components converge, the ensuing transfer will be vital.

The query now turns into whether or not this rally represents a everlasting repricing of silver’s worth in an electrified, AI-powered world, or an over-correction. Given the persistent nature of the supply-demand imbalance and the continued build-out of power infrastructure, the case for sustained power appears compelling. However as with all markets, nothing strikes in a straight line eternally.