Andrii Dodonov/iStock through Getty Pictures

REIT Efficiency

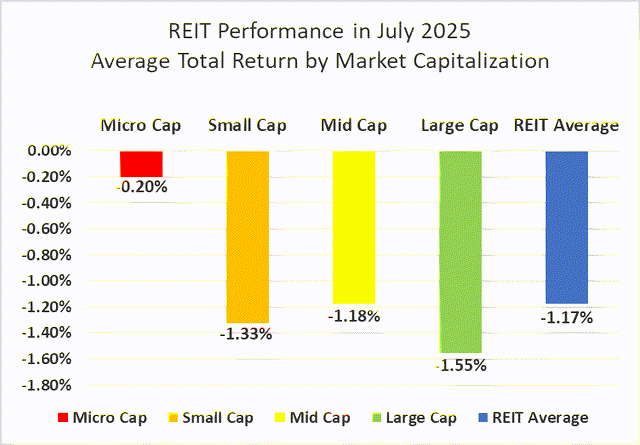

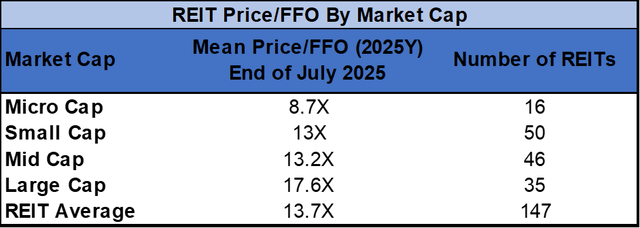

REITs averaged a modest decline in July (-1.17%), once more falling wanting the broader market, which noticed optimistic returns from the NASDAQ (+3.7%), S&P 500 (+2.2%), and Dow Jones Industrial Common (+0.2%). The market cap-weighted Vanguard Actual Property ETF (VNQ) barely outperformed the common REIT in July (+0.09% vs. -1.17%) and has dramatically outperformed year-to-date (+2.10% vs. -6.42%). The unfold between the 2025 FFO multiples of huge cap REITs (17.6x) and small cap REITs (13.0x) widened in July as multiples held regular for giant caps however contracted 0.3 turns for small caps. Buyers at present have to pay a median of 35.4% extra for every greenback of FFO from large-cap REITs relative to small-cap REITs. On this month-to-month publication, I’ll present REIT information on quite a few metrics to assist readers establish which property sorts and particular person securities at present supply the most effective alternatives to realize their funding objectives.

Supply: Graph by Simon Bowler of 2nd Market Capital, Information compiled from S&P International Market Intelligence LLC. See essential notes and disclosures on the finish of this text

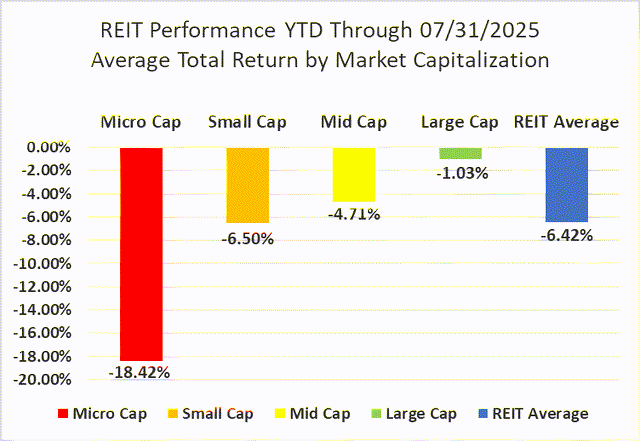

After badly underperforming in every of the primary 5 months of 2025, micro-cap REITs (-0.20%) have now outpaced their bigger friends in back-to-back months as mid-caps (-1.18%), small caps (-1.33%), and enormous caps (-1.55%) averaged deeper adverse returns in July. Through the first seven months of 2025, giant cap REITs have outperformed small caps by 547 foundation factors.

Supply: Graph by Simon Bowler of 2nd Market Capital, Information compiled from S&P International Market Intelligence LLC. See essential notes and disclosures on the finish of this text

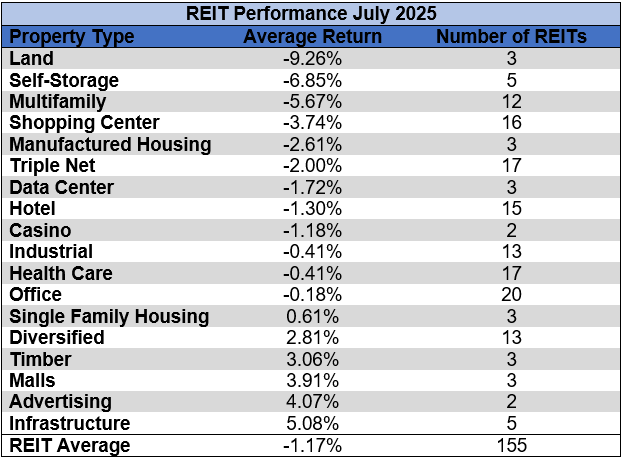

Solely 6 out of 18 Property Sorts Averaged Optimistic Returns in July

66.67% of REIT property sorts averaged a adverse complete return in July. There was a 14.34% complete return unfold between the best- and worst-performing property sorts. Infrastructure (+5.08%) and Promoting (+4.07%) noticed the strongest returns in July. Land (-9.28%) and Self Storage REITs (-6.85%) underperformed all different REIT property sorts.

Supply: Desk by Simon Bowler of 2nd Market Capital, Information compiled from S&P International Market Intelligence LLC. See essential notes and disclosures on the finish of this text

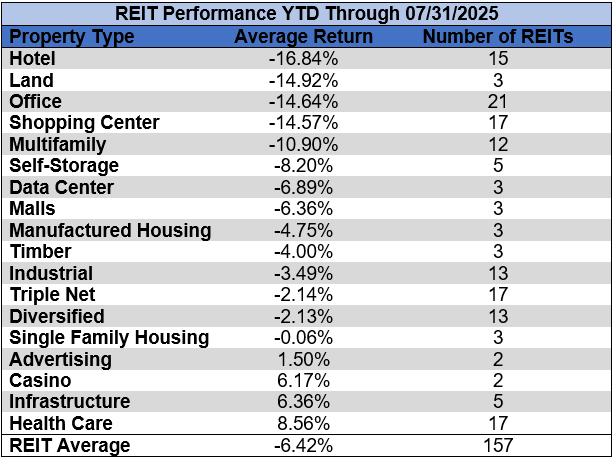

Resort (-16.84%), Land (-14.92%), Workplace (-14.64%), Purchasing Middle (-14.57%), and Multifamily REITs (-10.90%) struggled over the primary seven months of 2025 with double-digit common declines. Well being Care (+8.56%), Infrastructure (+6.36%), On line casino (+6.17%), and Promoting (+1.50%) had been the one property sorts to common optimistic returns over the primary seven months of the 12 months.

Supply: Desk by Simon Bowler of 2nd Market Capital, Information compiled from S&P International Market Intelligence LLC. See essential notes and disclosures on the finish of this text

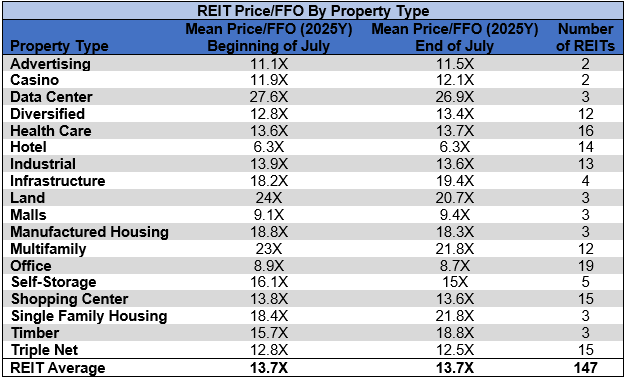

The REIT sector as an entire noticed the common P/FFO (2025Y) stay unchanged at 13.7x in July. 44.4% of property sorts averaged a number of enlargement, 50% averaged a number of contraction, and 5.6% noticed multiples maintain regular in July. Information Facilities (26.9x), Single Household Housing (21.8x), Multifamily (21.8x), Land (20.7x), and Infrastructure (19.4x) at present commerce on the highest common multiples amongst REIT property sorts. Inns (6.3x), Workplace (8.7x), and Malls (9.4x) are the one property sorts that common single-digit FFO multiples.

Supply: Desk by Simon Bowler of 2nd Market Capital, Information compiled from S&P International Market Intelligence LLC. See essential notes and disclosures on the finish of this text

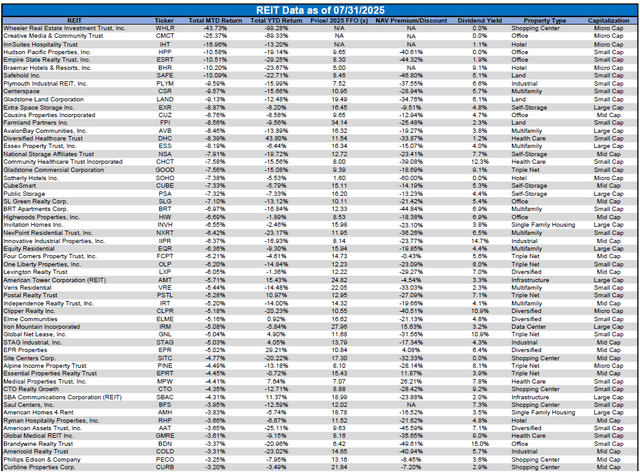

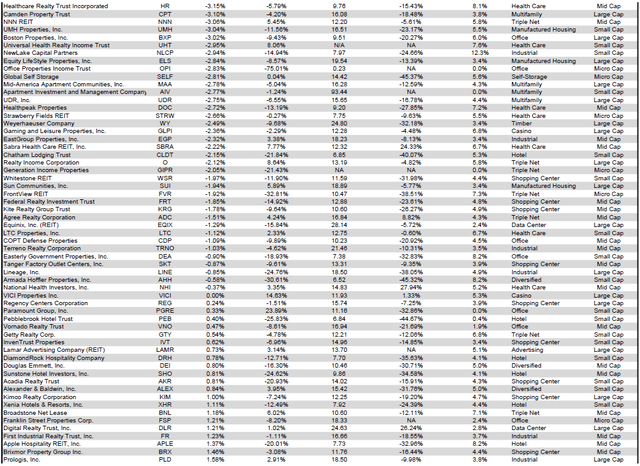

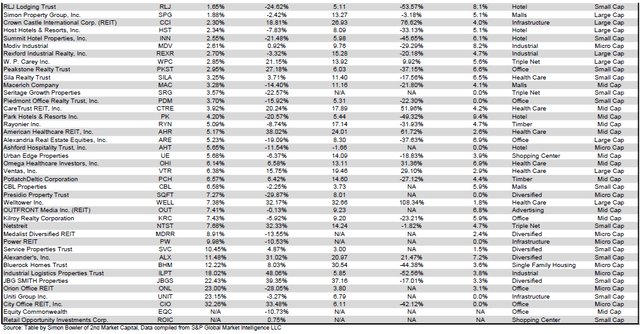

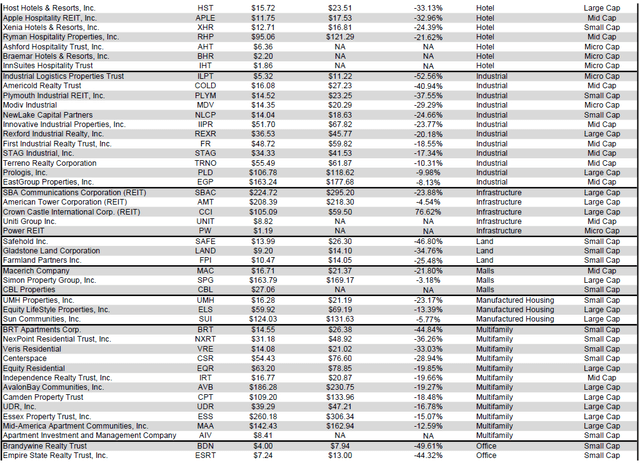

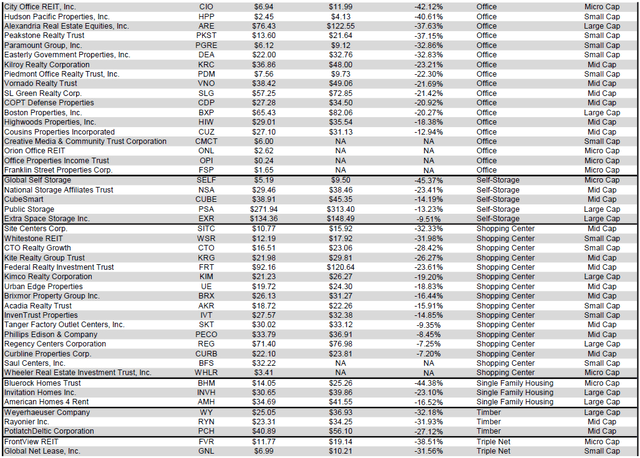

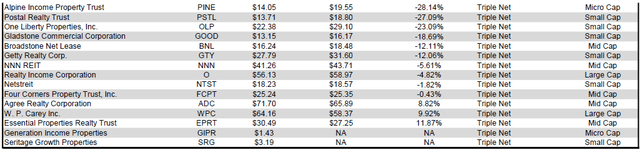

Efficiency of Particular person Securities

Metropolis Workplace REIT (CIO) (+32.26%) surged in July after saying on July 24th that they are going to be acquired by MCME Carell at a worth of $7.00/share. The transaction is anticipated to shut throughout the 4th quarter of 2025. CIO additionally introduced that the July 24th dividend was the ultimate frequent dividend distribution and that the frequent dividend shall be suspended by means of the shut of the acquisition.

After a uncommon month within the black in June (+52.26%), Wheeler REIT (WHLR) returned to freefalling in July (-43.73%) because it underperformed all different REITs. Over the primary 7 months of 2025, WHLR has amassed a sector-worst -99.28% complete return.

39.35% of REITs had a optimistic complete return in July. REITs have averaged a -6.42% year-to-date complete return in 2025, which falls far wanting the +3.83% return for the REIT sector over the primary seven months of 2024.

For the comfort of studying this desk in a bigger font, the desk beneath is out there as a PDF as effectively.

Supply: Desk by Simon Bowler of 2nd Market Capital, Information compiled from S&P International Market Intelligence LLC. See essential notes and disclosures on the finish of this text Supply: Desk by Simon Bowler of 2nd Market Capital, Information compiled from S&P International Market Intelligence LLC. See essential notes and disclosures on the finish of this text Supply: Desk by Simon Bowler of 2nd Market Capital, Information compiled from S&P International Market Intelligence LLC. See essential notes and disclosures on the finish of this text

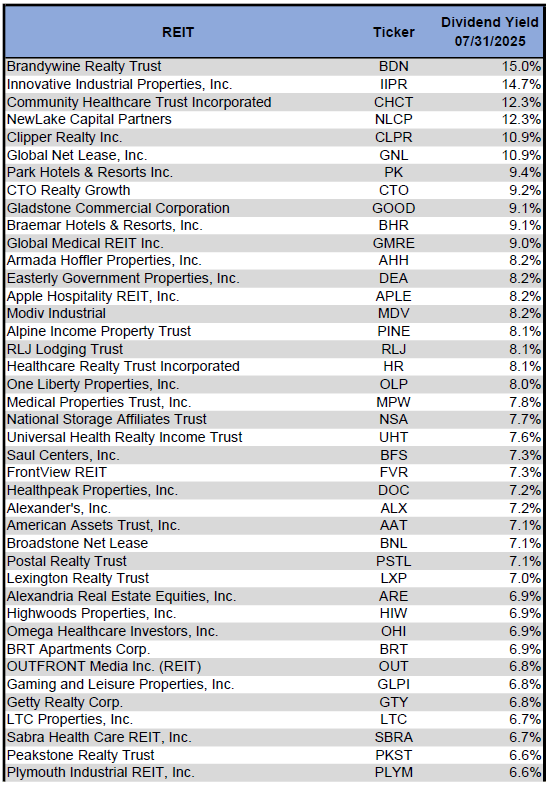

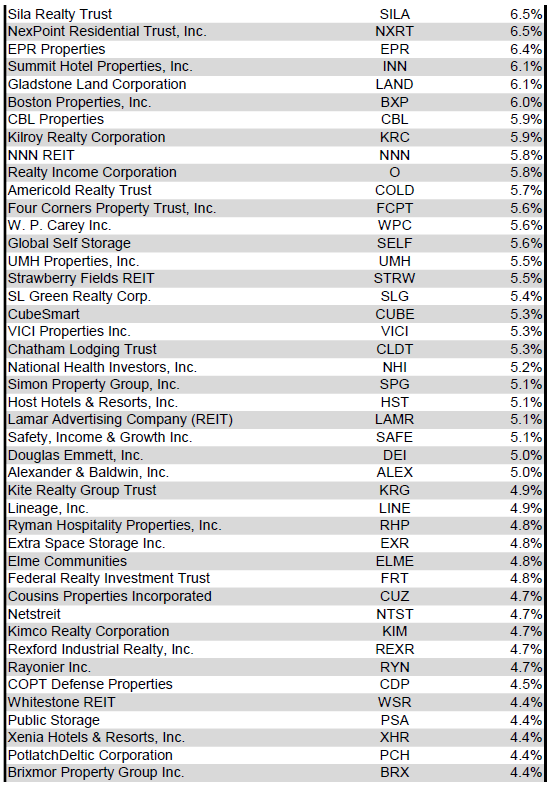

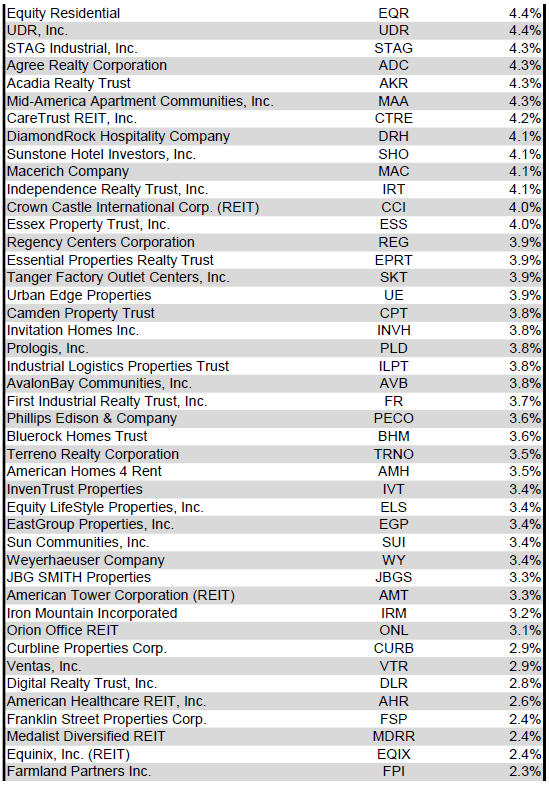

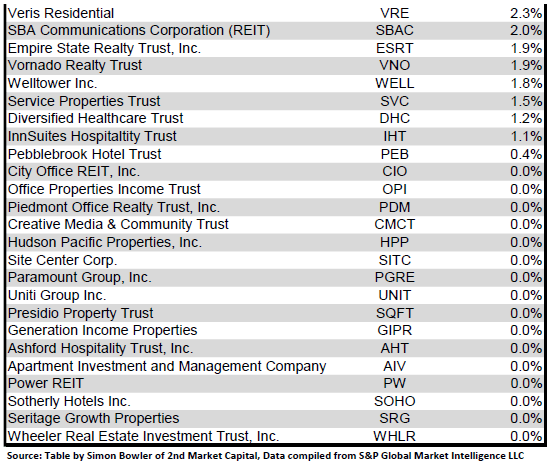

Dividend Yield

Dividend yield is a crucial part of a REIT’s complete return. The notably excessive dividend yields of the REIT sector are, for a lot of buyers, the first motive for funding on this sector. As many REITs are at present buying and selling at share costs effectively beneath their NAV, yields are at present fairly excessive for a lot of REITs inside the sector. Though a very excessive yield for a REIT could typically mirror a disproportionately excessive danger, there exist alternatives in some circumstances to capitalize on dividend yields which might be sufficiently engaging to justify the underlying dangers of the funding. I’ve included beneath a desk rating fairness REITs from highest dividend yield (as of seven/31/2025) to lowest dividend yield.

For the comfort of studying this desk in a bigger font, the desk beneath is out there as a PDF as effectively.

Supply: Desk by Simon Bowler of 2nd Market Capital, Information compiled from S&P International Market Intelligence LLC. See essential notes and disclosures on the finish of this text Supply: Desk by Simon Bowler of 2nd Market Capital, Information compiled from S&P International Market Intelligence LLC. See essential notes and disclosures on the finish of this text Supply: Desk by Simon Bowler of 2nd Market Capital, Information compiled from S&P International Market Intelligence LLC. See essential notes and disclosures on the finish of this text Supply: Desk by Simon Bowler of 2nd Market Capital, Information compiled from S&P International Market Intelligence LLC. See essential notes and disclosures on the finish of this text

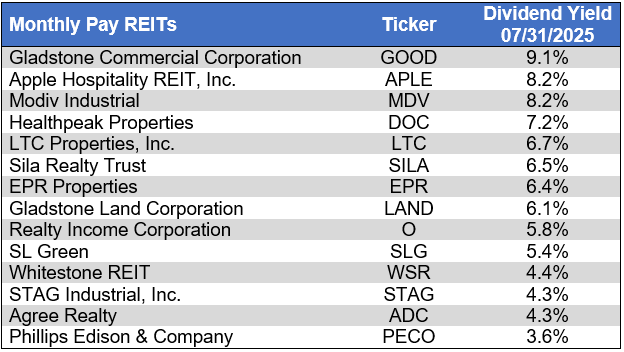

Though a REIT’s determination concerning whether or not to pay a quarterly dividend or a month-to-month dividend doesn’t mirror on the standard of the corporate’s fundamentals or operations, a month-to-month dividend permits for smoother money circulation to the investor. Under is a listing of fairness REITs that pay month-to-month dividends, ranked from highest yield to lowest yield.

Supply: Desk by Simon Bowler of 2nd Market Capital, Information compiled from S&P International Market Intelligence LLC. See essential notes and disclosures on the finish of this text

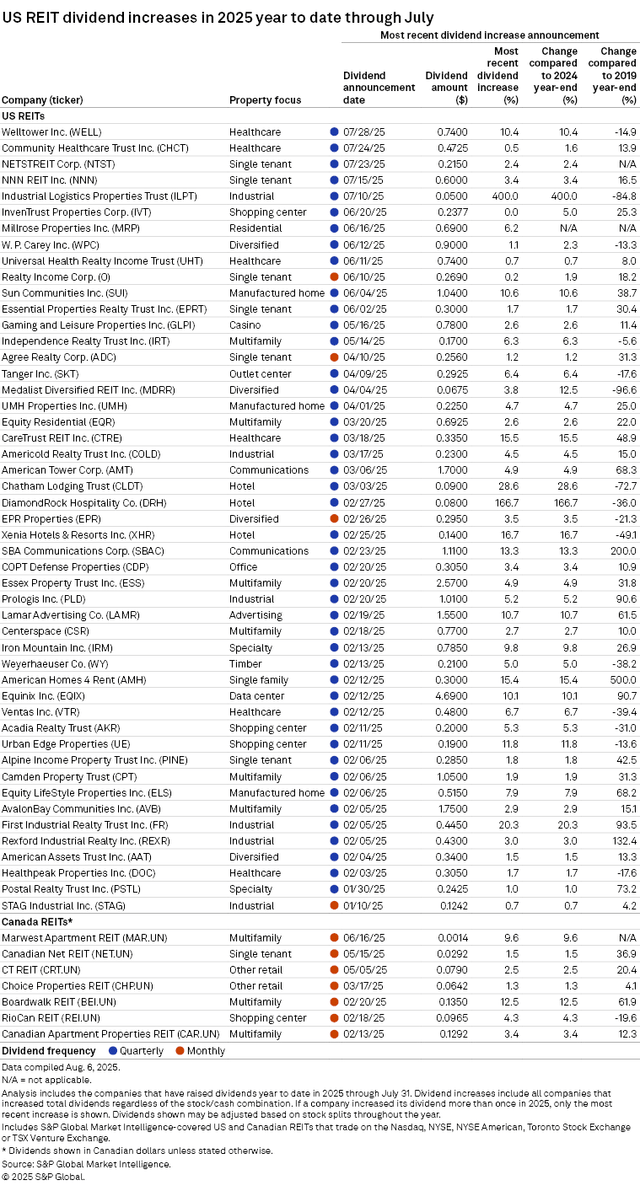

Dividend Information

5 REITs introduced quarterly dividend will increase in July. The biggest dividend improve got here from Industrial Logistics Properties Belief (ILPT) (+400.00%), which quintupled their dividend. Nevertheless, even after this hike, ILPT’s dividend remains to be 84.8% decrease than it was on the finish of 2019. In complete, 49 REITs have raised their dividend throughout the first seven months of 2025.

Supply: S&P International Market Intelligence

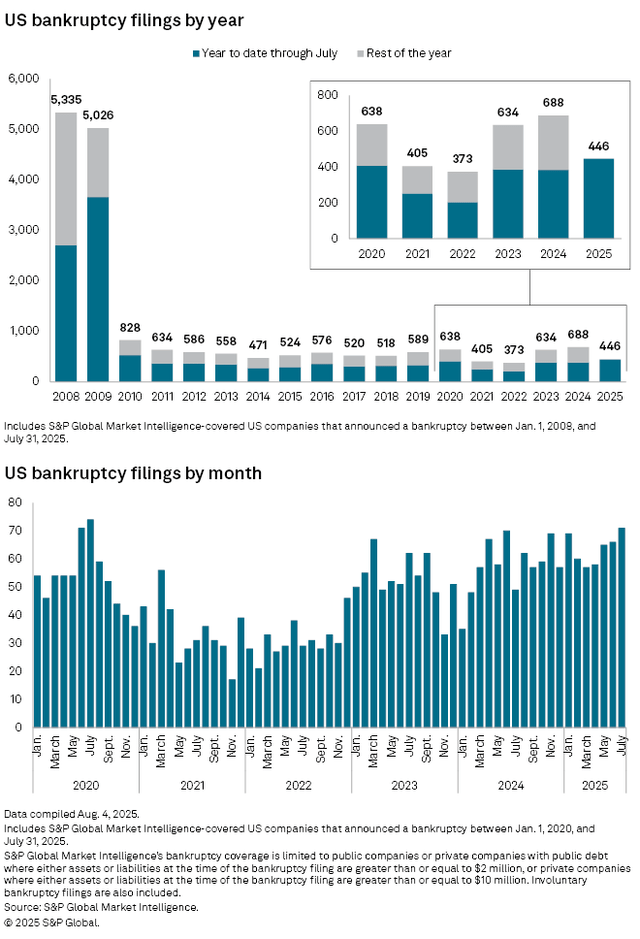

Financial Well being

The variety of company bankruptcies rose month-over-month for the 4th straight month in July (after an upward revision to June’s determine) and reached the very best month-to-month complete since July 2020 as elevated rates of interest proceed to pressure closely indebted firms. There have been extra filings year-to-date in 2025 than within the first 7 months of some other 12 months since 2010.

Supply: S&P International Market Intelligence

Valuation

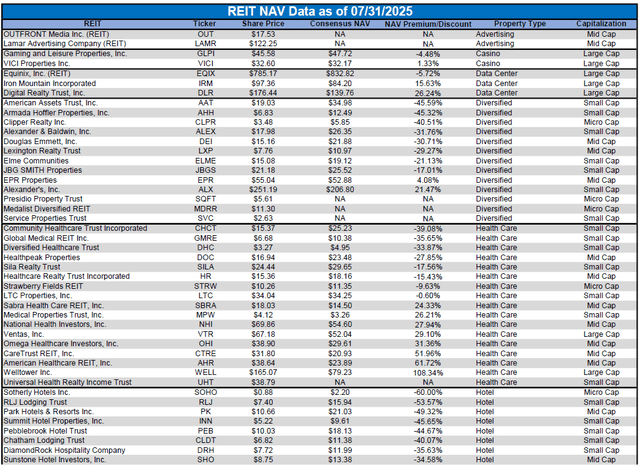

REIT Premium/Low cost to NAV by Property Kind

Under is a downloadable information desk that ranks REITs inside every property sort from the biggest low cost to the biggest premium to NAV. The consensus NAV used for this desk is the common of analyst NAV estimates for every REIT. Each the NAV and the share worth will change over time, so I’ll proceed to incorporate this desk in upcoming problems with The State of REITs with up to date consensus NAV estimates for every REIT for which such an estimate is out there.

For the comfort of studying this desk in a bigger font, the desk beneath is out there as a PDF as effectively.

Supply: Desk by Simon Bowler of 2nd Market Capital, Information compiled from S&P International Market Intelligence LLC. See essential notes and disclosures on the finish of this text Supply: Desk by Simon Bowler of 2nd Market Capital, Information compiled from S&P International Market Intelligence LLC. See essential notes and disclosures on the finish of this text Supply: Desk by Simon Bowler of 2nd Market Capital, Information compiled from S&P International Market Intelligence LLC. See essential notes and disclosures on the finish of this text Supply: Desk by Simon Bowler of 2nd Market Capital, Information compiled from S&P International Market Intelligence LLC. See essential notes and disclosures on the finish of this text

Takeaway

The massive cap REIT premium (relative to small cap REITs) widened in July, and buyers at the moment are paying on common about 35% extra for every greenback of 2025 FFO/share to purchase giant cap REITs than small cap REITs (17.6x/13.0x – 1 = 35.4%). As could be seen within the desk beneath, there may be presently a robust optimistic correlation between market cap and FFO a number of.

Supply: Desk by Simon Bowler of 2nd Market Capital, Information compiled from S&P International Market Intelligence LLC. See essential notes and disclosures on the finish of this text

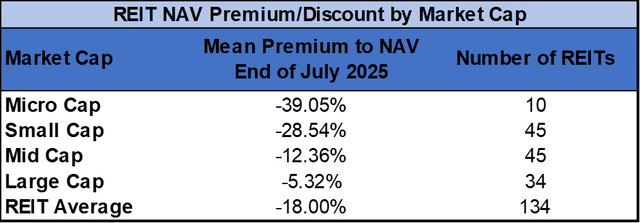

The desk beneath exhibits the common NAV premium/low cost of REITs for every market cap bucket. This information, very similar to the info for worth/FFO, exhibits a robust, optimistic correlation between market cap and Worth/NAV. The typical large-cap REIT (-5.32%) trades at a single-digit low cost to consensus NAV, and mid-cap REITs (-12.36%) commerce at a low double-digit low cost. Small-cap REITs (-28.54%) commerce somewhat beneath 3/4 of NAV, whereas micro-caps (-39.05%) commerce at solely about 3/5 of their respective NAVs.

Supply: Desk by Simon Bowler of 2nd Market Capital, Information compiled from S&P International Market Intelligence LLC. See essential notes and disclosures on the finish of this text

Blended July Inflation Information Leaves Potential Fee Lower Path Unclear

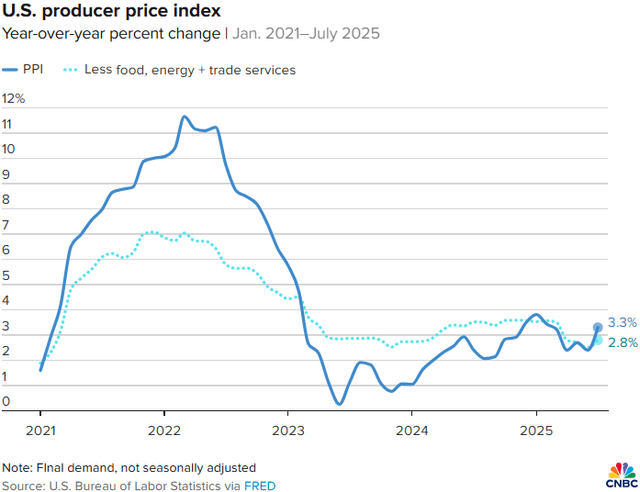

After declining properly by means of the primary half of 2025, the producer worth index (PPI) spiked up sharply (+0.9% month-over-month) in July. It isn’t but clear whether or not this sharp single-month improve in PPI displays a full or partial tariff impression, so it should make the subsequent few months of knowledge all of the extra essential to watch.

Supply: CNBC & U.S. Bureau of Labor Statistics

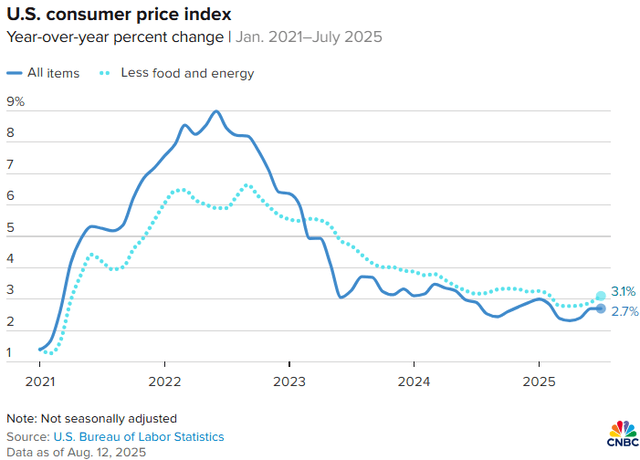

Customers, nevertheless, are nonetheless not but seeing any materials tariff impression as the patron worth index (CPI) held regular at 2.7% in July and stays decrease than the three% inflation firstly of the 12 months. The PPI is historically a number one indicator, so now we have but to see whether or not or to what extent the July PPI spike may cross by means of to shoppers over the upcoming months.

Supply: CNBC & U.S. Bureau of Labor Statistics

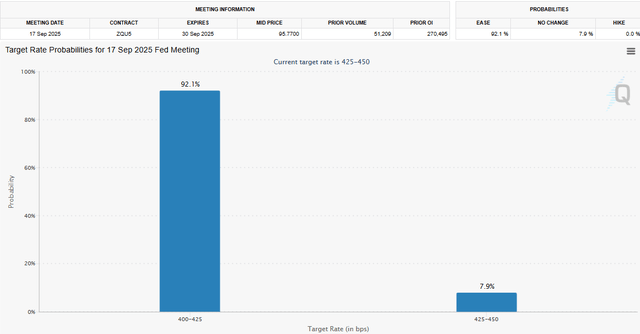

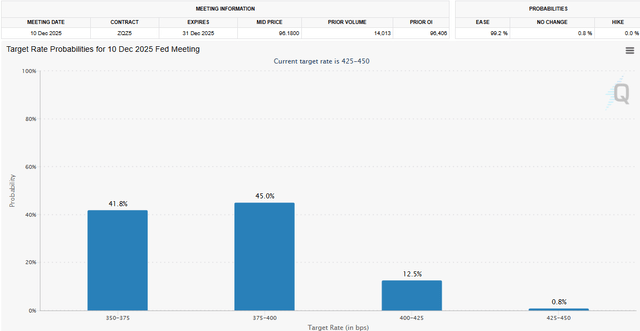

July thirtieth marked the fifth straight assembly at which the Fed Funds fee was left at 4.25% – 4.50%. Nevertheless, it additionally marked the primary assembly since 1993 during which two Fed governors dissented from a Fed determination. This dissent got here from a desire from each dissenting governors for a fee reduce. After seeing each the PPI and CPI information (in addition to many different information factors), FedWatch odds of a September fee reduce have risen to over 90% (as of 08/16).

Supply: CME Group FedWatch

FedWatch odds of at the very least one fee reduce by 12 months finish at the moment are over 99% (as of 08/16), with odds of a complete of 75 foundation factors of cuts now at 41.8%. These odds will change with every new financial information level launched, however at present recommend market expectations of a number of cuts starting in September.

Supply: CME Group FedWatch

The REIT sector obtained pummeled because the Fed quickly raised charges in a pointy course correction after their “transitory” inflation concept proved inaccurate. If the Fed initiates a brand new rate-cutting cycle, nevertheless, it may have the other impact for REITs, because it may gas cap fee compression and a decrease value of debt. Cap fee compression would increase the worth of REIT property, whereas a declining value of debt would facilitate accretive refinancings and enhance money circulation. Because of the better impression that adjustments in rates of interest have on the REIT sector relative to most different sectors of the markets, a strong rate-cutting cycle may drive REIT outperformance over upcoming quarters. Nevertheless, the timing and magnitude of cuts shall be closely impacted by a litany of financial information factors over the upcoming months, so lively buyers can be sensible to carefully comply with each particular person company-level reporting in addition to financial information tendencies to establish alternatives to realize alpha.

Editor’s Notice: This text covers a number of microcap shares. Please pay attention to the dangers related to these shares.