Alberfb/iStock through Getty Pictures

By Emily Balsamo and Eunice Son

At a Look

- Round 40% of grains and oilseed choices quantity is now traded at 30 days-to-expiry or much less.

- Weekly choices can provide better flexibility and extra granular hedging alternatives, complementing normal, long-dated American choices.

Agricultural derivatives are witnessing a structural shift in how members handle danger, categorical a view and commerce round key occasions lately. On the coronary heart of this transformation is the rising reputation of weekly and short-dated choices, in addition to the elevated prevalence of ordinary choices traded with shorter days-to-expiry (DTE).

Brief-Dated Choices: A Structural Shift

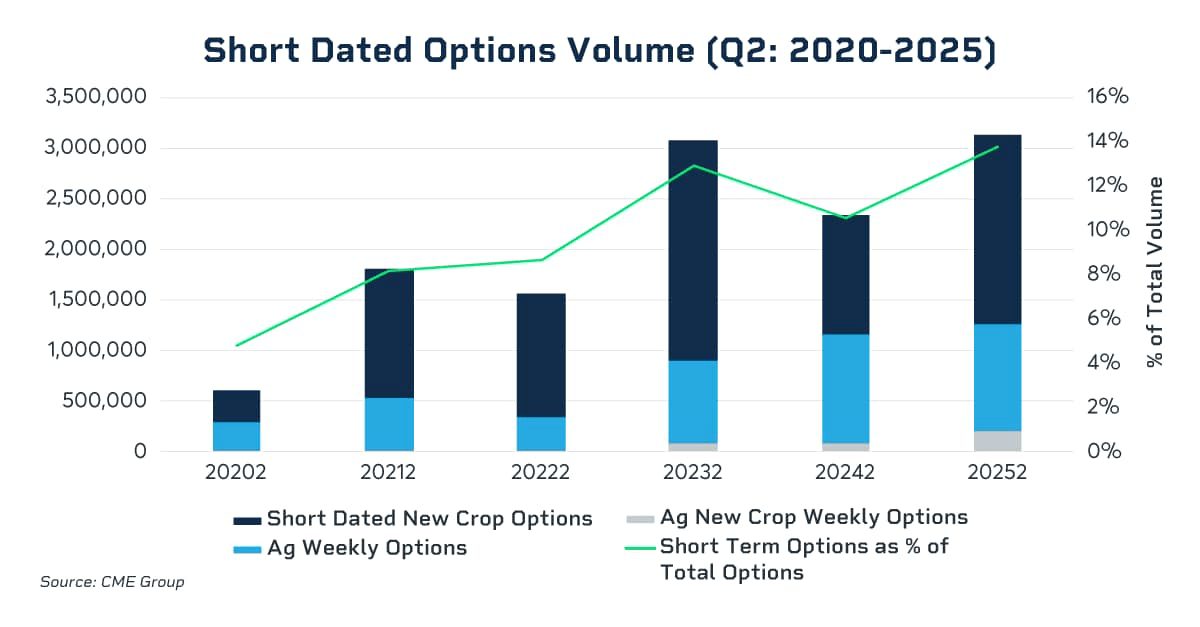

Whereas Friday Weekly choices have lengthy supplied shorter-term danger administration alternatives, Weekday choices on Corn, Soybean, Soybean Meal, Soybean Oil and Wheat futures that expire on Mondays, Tuesdays, Wednesdays and Thursdays had been launched in February 2025, providing enhanced flexibility. Within the grains and oilseed choices complicated, these shorter-term merchandise haven’t solely gained traction however now account for a big share of general buying and selling quantity. In Q2 2025, almost 14% of grains and oilseed choices quantity was attributable to short-dated choices, up from about 5% in the identical quarter of 2020.

Brief-Dated New Crop choices (SDNCOs) have additionally gained a powerful foothold within the grains and oilseed choices area. SDNCOs, that are month-to-month choices listed through the planting season and settling to November Soybean or December Corn futures, have more and more develop into devices of selection for market members looking for exact, short-term danger administration instruments tailor-made to particular crop cycles and pricing home windows. Together with New Crop Weekly choices, SDNCOs permit extra exact danger administration tied to planting and harvest, USDA reviews and climate occasions for brand new crop publicity. The recognition of SDNCOs underscores how choices markets are evolving, not simply by way of quantity but in addition in performance and danger administration.

Days to Expiration Development Down

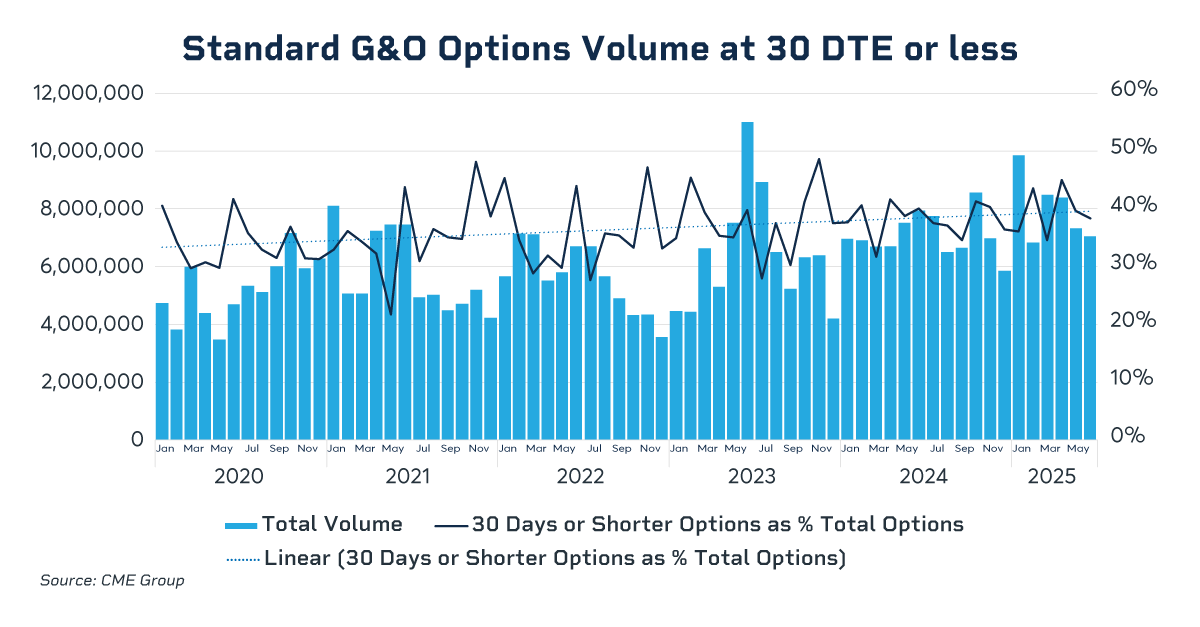

Whereas choices initially listed at quick tenors have pushed important development in grains and oilseed choices quantity lately, the complicated has additionally seen a development towards buying and selling normal long-dated choices at decrease common DTE.

Whereas Friday Weekly choices on grains and oilseed futures are listed for under three consecutive weeks out (and Monday by Thursday choices for under two), normal American choices on grains and oilseed futures are listed for as much as two years out. Though the itemizing cycles of ordinary American choices permit for long-term publicity, there is a rise in buying and selling exercise with fewer days to expiration for these merchandise as effectively, once more talking to the wants of market members to handle short-term danger.

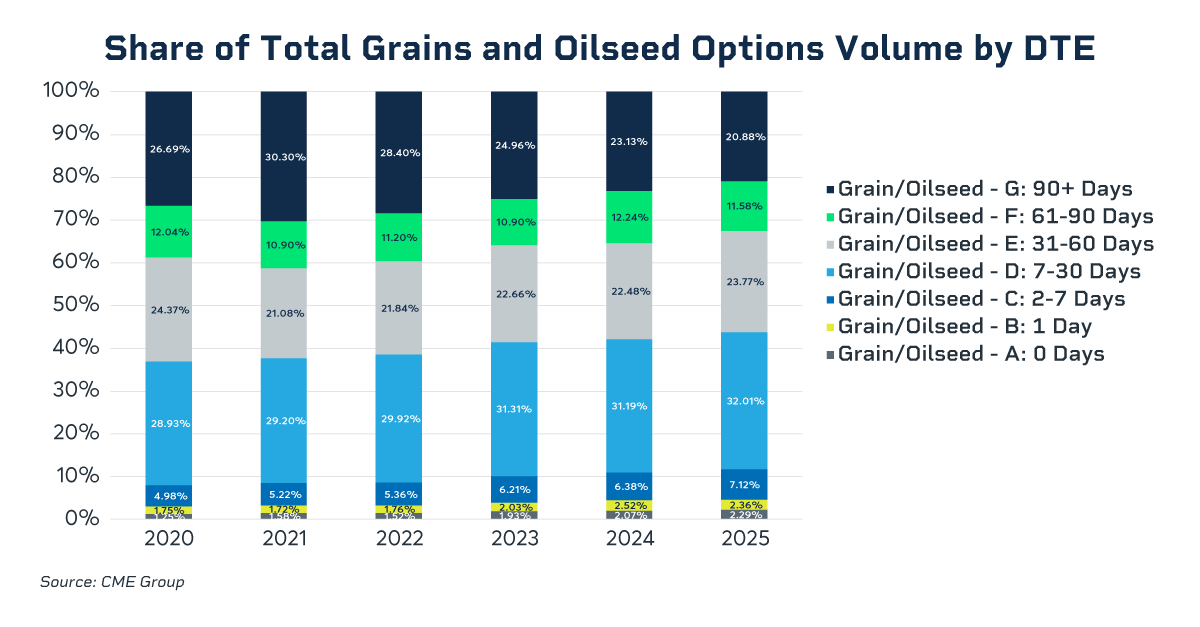

Within the first half of 2025, choices quantity at 30 DTE or much less made up over 40% of complete quantity. Inside that vary, the quantity of choices expiring between seven and 30 days is climbing, with shorter DTE buying and selling – similar to 0 day, 1 day, or 2-7 DTE quantity – taking over a rising portion of the full quantity in grains and oilseed choices merchandise. In 2020, almost 27% of grains and oilseed choices quantity was traded at 90 or extra DTE; in 2025, that share dropped to lower than 21%, whereas the share of choices buying and selling at 0 DTE has almost doubled, from 1.25% to 2.29% in that point.

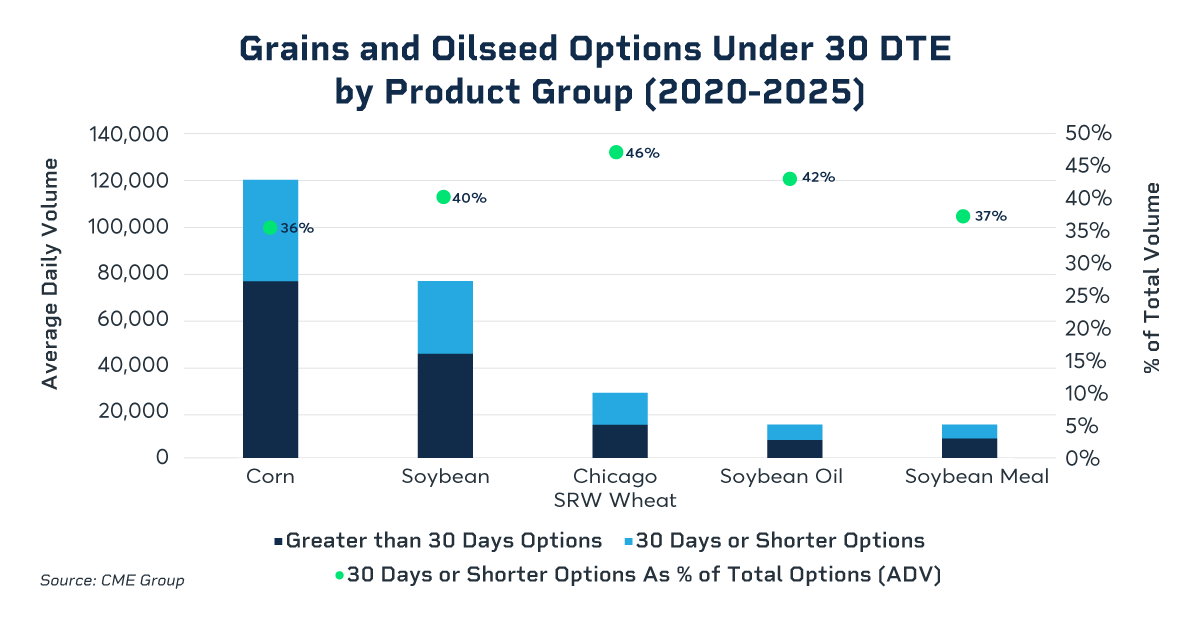

Since 2020, greater than 36% of quantity traded in choices with an underlying Corn future has occurred at 30 DTE or much less. Exceeding Corn’s share, 40% of complete Soybean and Soybean Oil choices quantity has been traded at 30 DTE or much less over that very same interval, with Chicago Wheat’s share exceeding 46%. The comparatively excessive share of low-DTE quantity throughout the Chicago Wheat choices complicated could replicate the wants of market members to hedge supply-side geopolitical danger, whereas Soybean Oil could carry demand-side, short-term in a single day danger as a consequence of adjustments in renewable gasoline coverage.

Choices Reply to New Danger Administration Wants

In an atmosphere the place provide chains are weak to climate shocks, geopolitics and shifting commerce insurance policies, short-dated choices and decrease DTE methods permit customers to hedge round particular occasions. The rising reputation of weekly and short-dated choices, coupled with the rising development of buying and selling longer-dated choices at a decrease common DTE, underscores a broader shift in market habits.

Editor’s Word: The abstract bullets for this text had been chosen by Looking for Alpha editors.